Coffee Futures: Arabica Down, Robusta Up in the Week Ended June 23

In this series, we’ll explore the price movements of five soft commodities—coffee, sugar, cocoa, orange juice, and cotton. Arabica coffee, which is considered superior in flavor and quality to Robusta coffee, has seen its futures price falling during the past six months.

June 27 2017, Updated 7:43 a.m. ET

Coffee prices

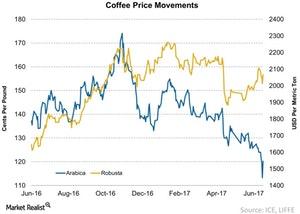

In the week ended June 23, 2017, Arabica coffee futures traded in negative territory week-over-week. In contrast, Robusta coffee futures rose week-over-week.

Arabica futures

The near-month futures for Arabica coffee, which are traded in the US on the Intercontinental Exchange (or ICE), fell 3% to $1.20 per pound on June 23 from $1.24 per pound on June 16, 2017.

On an average, Arabica coffee futures were trading 5% lower week-over-week to $1.19 per pound compared to an average of $1.26 per pound in the previous week.

Robusta futures

Similarly, the near-month futures for Robusta coffee, which are traded in London on the London International Financial Futures and Options Exchange (or LIFFE) ended in negative territory. Robusta coffee futures fell ~1.9% week-over-week to $2,067 per metric ton.

On an average, Robusta futures stood 16 basis points lower in the week ended June 23 compared to the previous week.

Forward curve

Arabica coffee, which is considered superior in flavor and quality to Robusta coffee, has seen its futures price falling over the past six months. The current market for Arabica is in contango with the futures curve, which slopes upward. Companies (JO) such as Dunkin’ Brands (DNKN), Starbucks (SBUX), Green Mountain Coffee (GMCR), and McDonald’s (MCD) pay close attention to forward curves.

In contrast to the Arabica coffee forward curve, the Robusta coffee forward curve shows that the near-month futures are trading at much higher prices than the furthest-month futures.

Series overview

In this series, we’ll explore the price movements of five soft commodities—coffee, sugar, cocoa, cotton, and orange juice.