AvalonBay: Weathering Ups and Downs in Residential REITs

In May 2017, 11 of 23 analysts covering AvalonBay Communities (AVB) stock issued “buy” or “strong buy” ratings. Eleven analysts gave AVB a “hold” rating, and one analyst gave it a “sell” or a “strong sell” rating.

June 13 2017, Updated 5:43 p.m. ET

AVB: Bright prospects ahead

The residential market has been on a bumpy ride for the past few quarters. Rental rates moderated in 2016 after remaining at record levels for the two previous years.

Demand remains high, as there is still a supply shortage—particularly in in-demand cities. Meanwhile, the Federal Reserve’s interest rate hikes may pose a challenge to the industry.

However, apartment owner AvalonBay Communities (AVB) does not seem to be deterred by the dark clouds that loom over the residential REIT sector. Backed by its strategic acquisitions and geographical diversity, the company is expected to follow a solid growth trajectory.

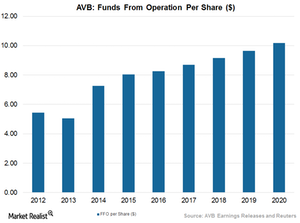

For 2017, AVB’s management expects its funds from operations (or FFO) per share to range between $8.59–$8.99. The company expects its core FFO to be in the range of $8.44–$8.84.

The company’s guidance is in line with analysts’ expectations of an FFO of $8.70 per share during 2017, up 5.3% from 2016. Its FFO is expected to rise 5.3% for 2018 and 2019 each and thereafter, it should rise 5.5% for 2020. Further, it has been able to maintain its earnings streak in recent years.

For the ongoing second quarter of 2017, AvalonBay’s management projects its FFO to range from $2.18–$2.24 per share. Its core FFO per share is expected to range between $2.07–$2.13. Analysts expect its FFO per share to reach $2.16, up 8.7% from 2Q16.

AVP’s FFO per share is expected to rise 3.5%, 8.2%, and 9.8% in 2018, 2019, and 2020, respectively.

Strong business momentum

After succumbing to a miss of 0.1% in 2012, AvalonBay Communities (AVB) has turned around and reported higher-than-expected funds from operations for the four years since 2013.

Apart from beating estimates, AVB’s FFO also exhibited year-over-year gains. After falling 7.2% in 2013, the company reported growth of 43.6%, 11%, and 2.6% in the trailing three years, respectively.

A strong start to 2017

AvalonBay Communities (AVB) reported 1Q17 earnings per share (or EPS) of $1.72 on April 27, 2017, beating its consensus estimate by nearly 58%. Its earnings also failed to meet its 1Q16 mark of $1.73 by 0.6%.

AVB’s adjusted FFO came in at $2.04, lower than the consensus estimate of 3.6%. The results came in lower than management’s expectation of an FFO range of $2.09–$2.15 per share. Its FFO also failed to meet the mark of $2.07 by 1.4% in 1Q16.

Lower margins were driven by a casualty loss due to a fire at the Avalon Maplewood apartment community in Maplewood, New Jersey. This event was responsible for the company’s lower year-over-year FFO and EPS during the quarter.

Stock price impact

Investors were encouraged by AvalonBay Communities’ (AVB) earnings results as well as the guidance provided by AVB, and its stock rallied after the earnings conference call on April 27, 2017. Although it opened at $188.14 on April 28, optimism among investors helped it gain almost 2% within two days.

For fiscal 2016, AvalonBay Communities reported FFO of $8.26 per share. Among its close competitors, Equity Residential (EQR), Essex Property Trust (ESS), and UDR (UDR) reported FFO per share of $2.96, $11.12, and $1.80, respectively.

The iShares Trust – iShares Residential Real Estate Capped ETF (REZ) witnessed a decline in traded volume during May 2017 compared to April 2017. The fall could have resulted from the macro uncertainty prevailing in the economy that could affect residential REITs negatively. AvalonBay Communities (AVB) forms 9% of REZ.

In this series, we’ll look into AvalonBay’s growth outlook, the effect of higher interest rates and government policies, debt leverage capability, shareholder returns, and valuations.

In the next article, we’ll look at the company’s recent performance.