AvalonBay—Comparison with Other Retail REITs in Its Industry

Currently, AvalonBay Communities is offering a next-12-month (or NTM) dividend yield of 3%, which is in line with its close competitors.

June 16 2017, Updated 10:35 a.m. ET

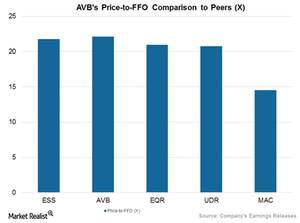

AVB’s price-to-FFO multiple

The most common way of assessing the relative value of a REIT like AvalonBay Communities (AVB) is by using its price-to-FFO[1. funds from operations] multiple. FFO is the most widely used metric for evaluating REITs.

A REIT’s price-to-FFO multiple is equivalent to the PE (price-to-earnings) ratio used to calculate a relative value for companies in other industries.

Peer group’s price-to-FFO multiple

AVB’s current price-to-FFO multiple is ~22.1x. The higher price-to-FFO multiple for AVB implies that the company has been returning consistent capital value and steady dividend yields to investors.

AVB has initiated several recent redevelopment projects. Plus, AvalonBay has undertaken several acquisitions and strategic partnerships to boost its presence in high-demand geographies. These actions may have given a push to its price movement.

Using its price-to-FFO multiple, AVB stock is trading in line with most of its peers. The exception is Macerich Company (MAC), which is trading at a low price-to-FFO multiple of ~14.5x. Essex Property Trust (ESS) is trading at ~21.8x, Equity Residential (EQR) is trading at ~20.9x, and UDR (UDR) is trading at ~20.8x.

Peer group dividend yield

Currently, AvalonBay Communities is offering a next-12-month (or NTM) dividend yield of 3%, which is in line with its close competitors. Equity Residential has a dividend yield of 3.2%, Essex Property has a dividend yield of 2.8%, and UDR has a dividend yield of 3.3%.

AvalonBay comprises 9% of the iShares Trust – iShares Residential Real Estate Capped ETF (REZ). The ETF’s yield was 5% on June 2, 2017.

In the final article in this series, we’ll see how analysts view AvalonBay Communities.