AvalonBay Communities: A Rewarding Stock for Shareholders

During 2016, AvalonBay Communities (AVB) repurchased 57,172 shares worth $0.6 million.

June 16 2017, Updated 7:36 a.m. ET

Why dividends matter for REITs

In order to function as real estate investment trusts (or REITs), companies like AvalonBay Communities (AVB) are required to pay at least 90% of their taxable income to investors in the form of dividends or share repurchases.

This exempts them from paying corporate taxes like companies in other industries. REITs fund their dividend payouts from their rental income paid by tenants occupying their properties. As a result, their returns provide secure and continuously flowing funds for dividends in the form of rental rates, which are directly proportional to inflation.

Consistent dividends

AvalonBay (AVB) has been paying dividends to its shareholders consistently in every quarter since it became a public company in 1994. On May 18, 2017, the company declared a cash dividend of $1.42 per share payable on July 17, 2017.

The company last hiked its dividend 5.2% during the 4Q16 earnings conference call. The dividend was paid on April 17, 2017, to shareholders of record on March 31, 2017.

The company also raised its dividend 8% to $1.35 per share on April 15, 2016. The company had a dividend yield of ~3.0% for 2016. Analysts expect its dividend yield to be ~3.0%, ~3.1%, and ~3.3% for 2017, 2018, and 2019, respectively.

FFO payout ratio

The funds from operations (or FFO) payout ratio is the portion a company distributes as dividends from of its FFO. It gives investors an idea of the shareholder return of a particular stock, and it’s calculated as the ratio between the dividend per share and diluted FFO per share for a given period.

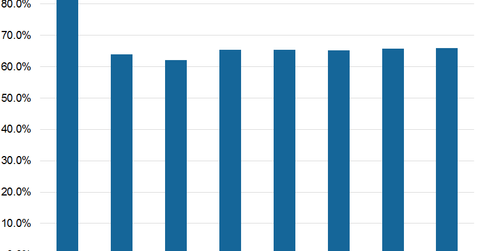

AVB’s FFO payout ratio was 66% in 1Q17. The company had payout ratios of 65%, 64%, 33%, and 60% in 4Q16, 3Q16, 2Q16, and 1Q16, respectively. The chart above shows the estimated dividend payout trend for the next four years.

AvalonBay also returns value to shareholders in the form of share repurchases. During 2016, the company repurchased 57,172 shares worth $0.6 million. The share repurchase is part of a $5 million share repurchase program announced in 2008.

Peer group

If we consider other REITs by comparing FFO payout ratios, we find that the payout ratio of AVB was in line with other REITs. For example, GGP Inc. (GGP) offered an FFO payout ratio of ~67.5% in 2016. It was followed by UDR’s (UDR) payout ratio of 64.4% and Essex Property Trust’s (ESS) payout ratio of 56.1%.

AvalonBay comprises 9% of the iShares Trust – iShares Residential Real Estate Capped ETF (REZ). This ETF had a yield of 5% on June 2, 2017.

In the next article, we’ll see how AVB performs in terms of leveraging its debt level.