Why Investors Weren’t Impressed by Starbucks’s Fiscal 2Q17

Starbucks (SBUX) posted its fiscal 2Q17 earnings after the market closed on April 27, 2017. Its EPS was $0.45 on revenues of $5.3 billion.

Dec. 4 2020, Updated 10:43 a.m. ET

Fiscal 2Q17 performance

Starbucks (SBUX) posted its fiscal 2Q17 earnings after the market closed on April 27, 2017. Its EPS (earnings per share) was $0.45 on revenues of $5.3 billion. Compared to fiscal 2Q16, EPS rose 15.4%, and revenue rose 6.0%.

Stock performance

Analysts were expecting the company to post EPS of $0.45 on revenues of $5.4 billion. The lower-than-expected SSSG (same-store sales growth) of 3.0% led Starbucks to post revenue lower than analysts’ estimate. Analysts were expecting the company to post overall SSSG of 3.7%. After posting lower-than-expected fiscal 2Q17 revenue, management expects the company’s fiscal 2017 revenue growth to be at the lower end of its 8.0%–10.0% guidance range. Management also reduced its adjusted EPS guidance for 2017 to $2.08–$2.12 from an earlier estimate of $2.12–$2.14.

The lower-than-expected fiscal 2Q17 SSSG and the lowering of the 2017 EPS guidance appear to have made investors skeptical of Starbucks’s future earnings, leading to a fall in SBUX stock. As of May 2, 2017, the company was trading at $60.49, which represents a fall of 1.3% since the announcement of its fiscal 2Q17 earnings on April 27, 2017.

Year-to-date performance

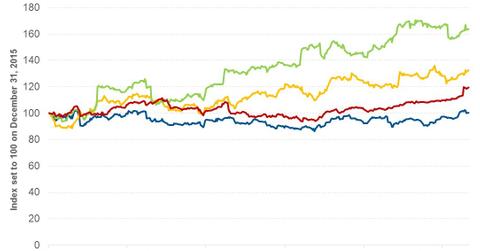

It was a transition year for Starbucks in 2016 when it shifted its loyalty program from a frequency-based to a spending-based structure. The stock fell 7.5%. However, 2017 started on a brighter note with the stock rising 9.0% since the beginning of the year. During the same period, Starbucks’s peers Dunkin’ Brands (DNKN), Domino’s Pizza (DPZ), and McDonald’s (MCD) have risen 8.2%, 15.8%, and 16.0%, respectively.

The broader comparative index, the S&P 500 Index (SPX), and the Consumer Discretionary Select Sector SPDR ETF (XLY) have risen 6.8% and 10.9%, respectively. XLY has 10.1% of its holdings invested in restaurant and travel companies.

Series overview

In this series, we’ll look at Starbucks’s fiscal 2Q17 performance and analysts’ estimates for the next four quarters. We’ll wrap up the series by looking at Starbucks’s valuation multiple and analysts’ recommendations for the next four quarters.

Let’s start by looking at Starbucks’s revenues in fiscal 2Q17.