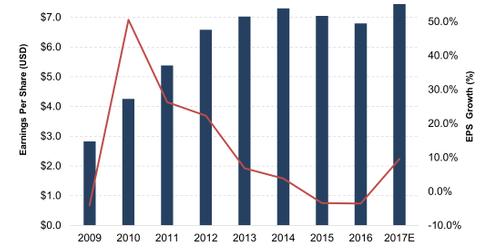

PVH Raises Its Earnings Guidance after Robust 1Q17 Results

PVH Corporation (PVH), which reported its 1Q17 results on May 24, 2017, saw its earnings rise 10% YoY (year-over-year) to $1.65 per share.

May 29 2017, Updated 9:07 a.m. ET

Earnings per share

PVH Corporation (PVH), which reported its 1Q17 results on May 24, 2017, saw its earnings rise 10% YoY (year-over-year) to $1.65 per share. The company outperformed the upper end of its guidance as well as Wall Street’s estimates. This was the 12th consecutive earnings beat for PVH.

“The EPS [earnings per share] beat was driven by a $0.06 business beat partially offset by $0.01 unfavorable FX,” said Mike Shaffer, PVH’s chief operating and financial officer.

Currency headwinds continued to reduce the company’s bottom line, hurting its 1Q17 EPS by $0.11.

Discussing the segment margins

The company’s gross profit rose 7.3% YoY to $1.1 billion as its gross margin expanded 175 basis points to 54.3% of sales. Its adjusted EBIT (earnings before interest and tax) rose 2.1% YoY to $192.5 million.

Tommy Hilfiger’s GAAP (generally accepted accounting principles) EBIT fell 16% YoY to $173 million. The fall was mostly due to the non-cash gains it recorded in 1Q16 on account of its Tommy Hilfiger China acquisition and costs related to agreements for the restructuring of its supply chain relationship in 1Q17. On a non-GAAP basis, PVH’s EBIT rose 18%, driven by higher revenue.

The Calvin Klein and Heritage Brands segments reported 3.3% and 6.7% rises in their GAAP EBITs, respectively, primarily due to the exclusion of several restructuring charges that had been recorded in 1Q16.

PVH raises its guidance

Encouraged by PVH’s 1Q17 performance, the company’s management has raised its 2Q17 and 2017 guidances. The company now expects to produce 2Q17 EPS in the $1.60–$1.63 range, compared to the expectation of $1.56.

For 2017, the company is looking for $7.40–$7.50 in earnings, which is $0.10 higher than its earlier guidance. The change comes as a result of a $0.05 rise due to favorable foreign currency and a 5% rise in its overall business.

ETF investors seeking exposure to PVH can consider the PowerShares S&P 500 High Beta ETF (SPHB), which invests ~1% of its portfolio in PVH.