Praxair in the Crosshairs: Analyst Recommendations and Target Prices

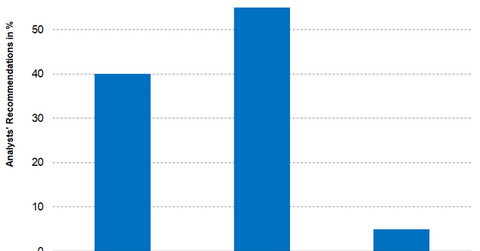

On May 26, of the 20 firms tracking Praxair (PX) stock, about 40.0% recommended “buys,” while 55.0% recommended “holds.”

June 1 2017, Updated 7:37 a.m. ET

Analysts’ recommendations for Praxair stock

On May 26, 2017, 20 brokerage companies were actively tracking Praxair (PX) stock. About 40.0% of those analysts recommended “buys” on the stock, and 55.0% recommended “holds.” The remaining 5.0% recommended “sells.”

The analysts’ consensus estimate indicates a 12-month target price of $132.47 for PX stock, implying a 12-month potential return of 0.4% over its closing price of $131.97 on May 26.

Why most analysts recommend “holds” or “buys” for Praxair

As Praxair’s 1Q17 earnings beat the analysts’ estimate, the upward revision of the lower end of its adjusted earnings per share would likely have influenced analysts to recommend “holds” or “buys” for Praxair. Notably, the stalled merger between Praxair and Linde AG could also get a green signal from the board and the shareholders.

Recommendations and target prices

Below are a few of the recommended target prices for PX from well-known brokerage companies:

- Deutsche Bank (DB) announced a target price of $130 for PX, but the stock was already trading 1.5% above the recommended price on May 26.

- Barclays (BCS) announced a target price of $135 for PX, implying a 12-month potential return of 2.3% over its closing price of $131.97 on May 26.

- HSBC rated Praxair as a “hold” with a target price of $117, implying a 12-month potential return of -11.3% over its closing price of $131.97 on May 26.

ETF investment

Investors can get indirect exposure to Praxair by investing in the iShares US Basic Materials ETF (IYM), which has 6.4% of its total portfolio in Praxair. The top holdings of IYM include DuPont (DD), Dow Chemical (DOW), and Monsanto (MON), which had weights of 11.5%, 11.6%, and 8.7%, respectively, on May 26.

In the next and final part of this series, we analyze Praxair’s latest valuations.