Investing in Simon Property Group: Relative Valuation

Simon Property Group’s current price-to-FFO multiple is ~14.1x.

May 22 2017, Updated 10:36 a.m. ET

Price-to-FFO multiple

The relative value of REITs like Simon Property Group (SPG) is calculated by comparing the price-to-FFO (funds from operations) multiple with the sector. FFO is widely used because it represents the main earnings metric for REITs similar to EPS (earnings per share) in other industries. A REIT’s price-to-FFO multiple is equivalent to the PE (price-to-earnings) ratio used in other industries.

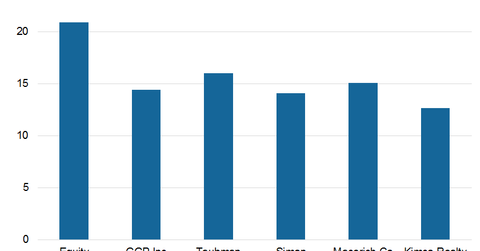

Peer group price-to-FFO multiple

Simon Property Group’s current price-to-FFO multiple is ~14.1x. Traditionally, this higher price-to-FFO multiple for Simon Property Group signifies that it has been able to provide consistent capital value return as well as reliable and steady dividend yields to investors. The recent expansion at King of Prussia Mall and developments at Clarksburg Premium Outlets must have had a positive effect on the current multiple.

The company’s forward price-to-FFO multiple stands at 13.9x. At this multiple, Simon Property Group stock is trading in line with most of its peers—except Taubman Centers (TCO), which is trading at a much higher multiple of 16.0x. General Growth Properties (GGP) is trading at 14.4x, while Macerich (MAC) is trading at 15.0x.

Higher multiple for Simon Property Group

Currently, the company is offering a next-12-month (or NTM) dividend yield of 4.4%, which is in line with its close competitors. For example, Macerich has a dividend yield of 4.9%, General Growth Properties (GGP) and Taubman Centres have dividend yields of 4.2% each, and Kimco Realty Corporation (KIM) has a dividend yield of 5.7%.

The NTM net asset value of Simon Properties is 10.1%, which is higher than its close competitors General Growth Properties’ net asset value of 5.9%, and Kimco Realty’s net asset value of 8.7%.

Simon Property Group and Public Storage (PSA) make up ~6.3% and 3.8%, respectively, of the Vanguard REIT ETF (VNQ).

In the final article in this series, we’ll see how analysts view Simon Property Group.