Why Did IFF’s Earnings Beat Analysts’ Estimates?

International Flavors & Fragrances (IFF) announced its 1Q17 earnings on May 8, 2017, after the market closed. It reported adjusted EPS of $1.52 in 1Q17.

May 10 2017, Published 9:01 a.m. ET

1Q17 earnings

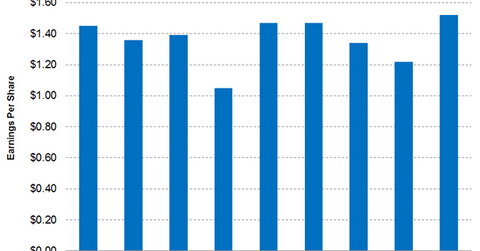

International Flavors & Fragrances (IFF) announced its 1Q17 earnings on May 8, 2017, after the market closed. The company reported adjusted EPS (earnings per share) of $1.52 in 1Q17—4.8% higher than adjusted EPS of $1.47 in 1Q16. International Flavors & Fragrances managed to beat analysts’ consensus estimate of $1.51 per share.

What drove earnings?

International Flavors & Fragrances’ 1Q17 adjusted earnings were primarily driven by the contribution from acquisition-related sales from David Michael and Fragrance Resources. Cost-saving initiatives and volume growth had a positive impact on earnings, while the foreign exchange hedge had a negative impact on earnings. Also, International Flavors & Fragrances bought back 312,289 common shares in 1Q17.

During 1Q17, International Flavors & Fragrances bought back 312,289 common shares and spent ~$37.6 million at an average purchase price of $120.44 per share. Under its repurchasing program, the company is still left with $71.7 million that can be used for share buyback going forward.

Stock price reaction and EPS guidance

International Flavors & Fragrances’ stock price reacted negatively and closed at $128.98. The stock price was ~6.1% due to lower-than-expected revenue in 1Q17.

International Flavors & Fragrances expects EPS, excluding the forex impact, to rise 6.5%–7.5% compared to the previous year. On an adjusted basis, International Flavors & Fragrances expects fiscal 2017 EPS to rise 3.5%–4.5%.

Investors can indirectly hold International Flavors & Fragrances by investing in the PowerShares DWA Basic Materials Momentum Portfolio ETF (PYZ). PYZ has invested 2.40% of its holdings in International Flavors & Fragrances as of May 8, 2017. The fund’s other top holdings include Chemours (CC), FMC (FMC), and Air Products and Chemicals (APD) with weights of 5.70%, 5.1%, and 4.0%, respectively.

In the next part, we’ll look at International Flavors & Fragrances’ revenue in 1Q17.