Gardasil and Merck’s Vaccines Business in 1Q17

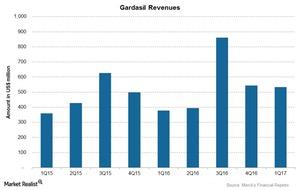

Gardasil is Merck’s (MRK) leading vaccine franchise. Total sales for Gardasil in 1Q17 were $532.0 million, a ~41.0% rise over $378.0 million in 1Q16.

May 24 2017, Updated 9:06 a.m. ET

Gardasil franchise

Merck and Co.’s (MRK) Gardasil franchise includes vaccines for preventing sexually-transmitted HPV (human papillomavirus). The total franchise sales for Gardasil in 1Q17 were $532.0 million, a ~41.0% rise over $378.0 million in 1Q16. That led to a contribution of ~5.6% of Merck’s total revenues for 1Q17.

Uses of Gardasil

Gardasil is used to prevent certain HPV strains that cause the majority of cases of cervical cancers and genital warts as well as other HPV-induced cancers such as anal, vulvar, vaginal, and penile cancers.

Merck’s vaccine business

Overall, Merck’s vaccine sales were ~$1.4 billion in 1Q17, which was nearly 23.0% higher than 1Q16 vaccine sales of $1.2 billion. Growth was driven by Gardasil, Pneumovax 23, RotaTeq, and Zostavax. ProQuad/Varivax reported nearly flat revenues of $355.0 million in 1Q17.

Also, SPMSD (Sanofi Pasteur and MSD), the joint venture between Sanofi Pasteur (SNY) and Merck & Co. (MRK) that developed and marketed vaccines in European markets, ended on December 31, 2016. So 1Q17 revenues include Merck’s vaccine sales in Europe, while they were reported as other income in 1Q16. Incremental sales due to the termination of this joint venture were $65.0 million in 1Q17.

Gardasil competes with GlaxoSmithKline’s (GSK) Cervarix, while the Pneumovax vaccine competes with Pfizer’s (PFE) Prevnar 13.

To divest the risk, you can consider the VanEck Vectors Pharmaceutical ETF (PPH), which holds ~5.2% of its total assets in Merck. PPH also holds 6.8% of its total assets in Pfizer (PFE), 5.1% in GlaxoSmithKline (GSK), and 4.5% in Novo Nordisk (NVO).