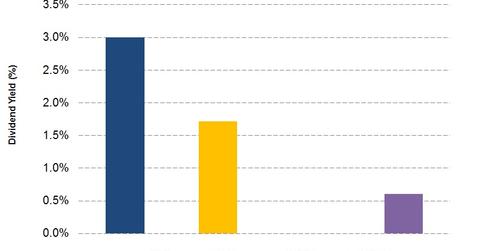

Dividend Yield in 2Q17: Comparing SLB, HAL, and NOV

Schlumberger’s (SLB) quarterly dividend per share remained unchanged from 2Q16 to 2Q17. In 2Q17, Schlumberger’s quarterly DPS is $0.50.

Aug. 10 2017, Updated 2:05 p.m. ET

Schlumberger’s dividend and dividend yield

Schlumberger’s (SLB) quarterly DPS (dividend per share) remained unchanged from 2Q16 to 2Q17. In 2Q17, Schlumberger’s quarterly DPS is $0.50.

Schlumberger’s dividend yield, expressed as dividend per share relative to the share price, is the highest among our set of OFS (oilfield equipment and services) companies. As of August 7, 2017, Schlumberger’s stock price fell 19%—compared to last year. Its unchanged DPS and lower stock price caused its dividend yield to rise ~3.0% as of August 7 from ~2.5% last year. Schlumberger accounts for 0.38% of the iShares Dow Jones US ETF (IYY). IYY rose 14% in the past year.

Halliburton’s dividend yield

Halliburton’s (HAL) quarterly DPS remained unchanged from 2Q16 to 2Q17. Halliburton’s 2Q17 quarterly DPS is $0.18. As of August 7, 2017, Halliburton’s stock price fell 6%—compared to last year. The unchanged DPS and lower stock price caused Halliburton’s dividend yield to rise marginally to 1.71% as of August 7 from 1.65% last year. Weatherford International (WFT) doesn’t pay a dividend.

Is National Oilwell Varco’s dividend yield the lowest?

As of August 7, 2017, National Oilwell Varco’s (NOV) dividend yield fell to 0.60% from 0.62% last year. In the past year, National Oilwell Varco’s stock price fell 8%. Earlier, National Oilwell Varco reduced its quarterly dividend 89% to $0.05 per share in April 2016. It wanted to preserve capital following a sustained decline in energy prices.

In the next part, we’ll compare the relative valuation multiples for these OFS energy stocks.