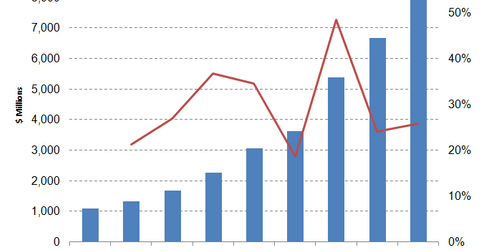

Chart in Focus: Salesforce’s Revenue Growth in 2017

In the past seven years, including its fiscal 4Q17 results, Salesforce (CRM) has met or exceeded analysts’ expectations with each passing quarter.

May 18 2017, Updated 4:36 p.m. ET

Trend of meeting or beating analysts’ expectations

Previously in this series, we discussed the factors that led Salesforce stock to reach its all-time high last week. We also discussed analysts’ expectations from the soon-to-be-announced Salesforce’s (CRM) fiscal 1Q18 earnings.

In the past seven years, including its fiscal 4Q17[1. quarter ended January 31, 2017] results, the company has met or exceeded analysts’ expectations with each passing quarter. In our view, we believe that Salesforce’s fiscal 1Q18 earnings could continue this trend.

Increased cloud adoption to enhance Salesforce’s prospects

In 2016, the cloud market grew 25% on an annualized basis to reach $148 billion. Amazon (AMZN) leads the cloud market, followed by Microsoft (MSFT), IBM (IBM), and Google (GOOG). Together, they dominate more than half of the cloud space.

Increased cloud adoption and the dominance of SaaS[2. software-as-a-service] in the cloud space has benefited Salesforce in particular, which derives the majority of its revenues from subscription and support revenues. Although it lost its leadership to Microsoft in the SaaS space, Salesforce is a leader in the CRM[3. customer relationship management] space.

Salesforce’s double-digit revenue growth with each passing quarter has enabled it to raise its guidance. It expects revenues and EPS (earnings per share) of $2.34 billion–$2.35 billion and $0.25–$0.26, respectively, in fiscal 1Q18. Salesforce aims to record $20 billion in revenues by fiscal 2021–2022.