Boston Scientific’s Acquisition of EndoChoice: Must-Know Details

On September 27, 2016, Boston Scientific (BSX) announced the acquisition of EndoChoice Holdings for $210 million.

Sept. 28 2016, Updated 2:04 p.m. ET

Deal overview

On September 27, 2016, Boston Scientific (BSX) announced the acquisition of EndoChoice Holdings for $210 million. According to the deal terms, Boston Scientific will launch a tender offer for the outstanding shares of EndoChoice for $8 per share.

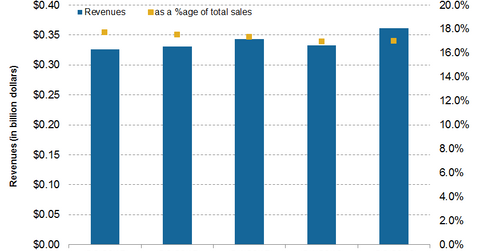

The acquisition is expected to be completed by 4Q16. It’s expected to be earnings accretive after 2017. After the acquisition, EndoChoice Holdings will be part of Boston Scientific’s endoscopy business. The graph above shows Boston Scientific’s endoscopy segment performance in the recent quarters.

Strategic benefits and opportunities of the deal

EndoChoice Holdings, based near Georgia, manufactures platform technologies for the treatment of a wide range of gastrointestinal problems. The technologies include endoscopic imaging systems and devices, and infection control products. In the 12-month period ending June 30, 2016, EndoChoice Holdings generated sales of approximately $75 million.

According to Art Butcher, senior vice president and president of Boston Scientific’s endoscopy business, “The addition of EndoChoice products and services to our portfolio supports our strategy to provide comprehensive solutions to gastroenterology caregivers and the patients they serve. We expect the acquisition to expand our leadership into new categories in the endoscopy market, and to drive strong, continued growth of our endoscopy business.”

Other major Boston Scientific competitors that have recently been involved in a number of mergers and acquisitions in the US medical device industry include Abbott Laboratories (ABT), Stryker (SYK), and Zimmer-Biomet Holdings (ZBH). The First Trust Health Care AlphaDEX Fund (FXH) invests approximately 2.1% of its portfolio in Boston Scientific.

Next, let’s discuss the approval of Boston Scientific’s latest TAVR system in Europe.