A Closer Look at Disney’s Financials

Walt Disney (DIS) is carrying a total debt of $21.6 billion. But can it easily pay the interest?

May 23 2017, Updated 4:05 p.m. ET

How much debt is Disney really carrying?

Walt Disney (DIS) is carrying a total debt of $21.6 billion. This figure can be found by adding the company’s short-term debt of ~$4.9 billion to its long-term debt of $16.8 billion. Since the company has total capital of $68.9 billion, its total-debt-to-total-capital ratio comes in at 30%.

If we look at the company’s debt in relation to assets, equity, and EBITDA (earnings before interest, tax, depreciation, and amortization), we find that it has debt-to-assets, debt-to-equity, and debt-to-EBITDA of 0.24, 49.45, and 1.26, respectively.

But can Walt Disney easily pay interest on its outstanding debt?

The answer lies in examining the company’s EBIT-to-interest ratio, also referred to as its interest coverage ratio, which, in this case, is 134.9x. This ratio sheds light on the company’s ability to pay interest on its debt.

Disney has a debt-to-enterprise-value ratio of 11%.

Disney’s price and valuation multiples

Walt Disney’s current book value per share of ~$27.7 compares with its expected book value per share of ~$26.3. The company’s shares are now trading at a price-to-book value of ~3.9x.

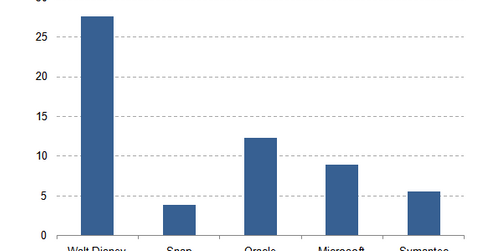

By comparison, peers Snap (SNAP), Oracle (ORCL), Microsoft (MSFT), and Symantec (SYMC) have current book values per share of $3.91, $12.32, $9.03, and $5.64, respectively.

Disney’s price-to-sales ratio of 3.03x also compares with its estimated price-to-sales ratio of 2.97x.

Disney’s cash flow metrics

Disney has $3.8 billion in cash in hand. Its price-to-cash-flow and price-to-free-cash-flow are ~14.1x and ~25.3x, respectively. In the trailing 12 months, the company’s EV-to-cash-flow comes in at 15.9x, while its EV-to-free-cash-flow comes in at ~24.7x.