Could Lower Tax Rates Affect Municipal Bonds Negatively?

For investors in the top tax bracket, municipal bond (XMPT) yields on a tax-equivalent basis are roughly 5.0%.

April 5 2017, Updated 2:05 p.m. ET

VanEck

BUTCHER: The last time tax rates fell was during Ronald Reagan’s presidency, and the muni market had quite a time adjusting. Will it suffer the same fate or have as much difficulty adjusting this time around?

COLBY: Reaganomics introduced the notion that a significant change in the tax code could occur, and it did occur: Tax rates for the highest marginal tax bracket came down during his administration to 28% from 50%. To some degree, there is a parallel to what we could experience in the coming months.

A reasonable thought is that lower tax rates mean less demand for the tax exemption that municipals offer. But throughout the 1980s, there was considerable growth in municipal tax-exempt money market funds and municipal tax-exempt bond funds. Assets in the muni space increased significantly, from about $300 billion under management to $1 trillion.

The question is whether the same jump in demand will occur this time. While we don’t yet know the answer, the experience of the Reagan era shows that munis cannot only survive, but also flourish in a lower-tax environment.

BUTCHER: Where do you see opportunities?

COLBY: There are good stories to tell in the investment-grade and high-yield parts of the market. The main advantage of municipal high-yield compared to other asset classes these days continues to be that nominal municipal yields are higher than those found in corporate high-yield. Corporate high-yield has had a terrific run in the past two or three months due to great demand, which has brought corporate yields down. But municipal high-yield has lagged somewhat, giving it the slight advantage.

Market Realist

For investors in the top tax bracket, municipal bond (XMPT) yields on a tax-equivalent basis are roughly 5.0%. That’s much more attractive than investment-grade corporates and Treasuries (TLT), which are yielding 3.0% and 1.5%, respectively. But even if tax rates are slashed, municipal bonds are still more attractive than the others. If the tax rate falls to 30.0%, municipal bonds would yield 3.8% on a tax-equivalent basis. Municipal bonds also come with safety of principal, low volatility, and attractive income.

Historically, there hasn’t been a high correlation between federal tax rates and municipal bond returns. While there might be a knee-jerk reaction to a tax cut, it will create a buying opportunity as municipal bond yields seem attractive, even after factoring in lower tax rates.

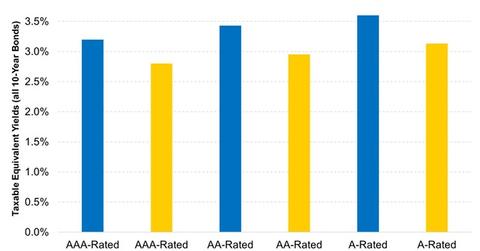

The above graph compares the yields on municipal bonds with yields on corporate bonds (LQD) with the same ratings, on a tax-equivalent basis, assuming a 35.0% tax rate. The graph suggests that investment-grade municipal bonds seem more attractive than investment-grade corporate bonds.