Why DuPont Trades at a Premium to Its Peers

As of April 18, 2017, DD traded at a one-year forward PE multiple of 20.60x.

April 20 2017, Updated 9:07 a.m. ET

DuPont’s forward PE

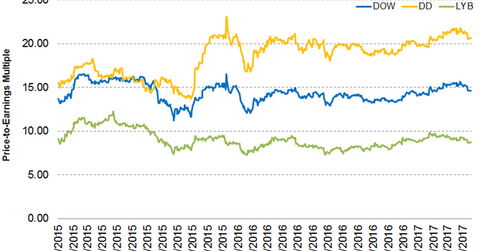

In the previous part of this series, we looked at analyst recommendations for DuPont. In this section, we’ll analyze DuPont’s (DD) valuation with that of its peers. As of April 18, 2017, DD traded at a one-year forward PE multiple of 20.60x as compared to its peers Dow Chemicals (DOW) and LyondellBasell (LYB), which are trading at one-year forward PE multiples of 14.6x and 8.8x, respectively.

Forward price-to-earnings (or PE) is a relative valuation method that considers the company’s future earnings for calculation. The forward price-to-earnings ratio tells how much investors are paying for the stock per dollar of expected earnings in the next 12 months. It’s one of the most popular valuation tools that help investors to compare two or more companies that operate in the same industry to see which stock is overvalued or undervalued.

DuPont trades at a premium

At present, DuPont is trading at a premium to its peers Dow Chemical and LyondellBasell. In the past few years, all three companies have been struggling for revenue growth. However, DOW Chemical’s revenues are expected to rise in 2017 on the complete takeover of Dow Corning’s stake from Corning (GLW). LyondellBasell’s revenue is also projected to grow in 2017 primarily due to lower scheduled maintenance. However, analysts expect marginal revenue growth in 2017.

With DuPont’s 2016 global cost savings and restructuring plan helping the company to save $750 million in cost reductions in 2016, analysts expect 2017 earnings per share to be at $3.71 in 2017 and $4.03 in 2018, representing a growth of 30.2% and 8.6%, respectively, on a year-over-year basis. However, with DuPont receiving conditional approval from the European Commission (EC) for the proposed merger between DuPont and Dow Chemical, shareholders will likely benefit from synergies from the merger.

Investors can get exposure to DuPont by investing in the iShares U.S. Basic Materials ETF (IYM). IYM invests 11.7% of its portfolio in DuPont as of April 18, 2017.