Why Analysts Say ‘Hold’ for Domino’s Stock ahead of Q1 Earnings

As of April 21, 2017, Domino’s Pizza (DPZ) was trading at $179.3. Domino’s stock price might have factored in the estimates we discussed in our previous articles.

Dec. 4 2020, Updated 10:53 a.m. ET

Target price

As of April 21, 2017, Domino’s Pizza (DPZ) was trading at $179.3. Domino’s stock price might have factored in the estimates we discussed in our previous articles. In this article, we’ll look at what analysts are recommending ahead of its 1Q17 earnings.

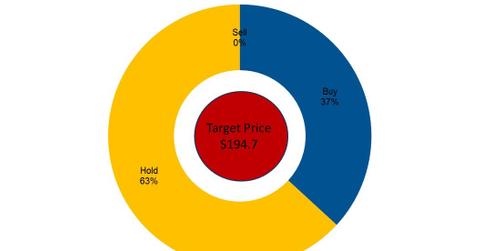

Although Domino’s stock price has fallen since the announcement of fiscal 4Q16 earnings, analysts have raised their price targets for the next 12 months. As of April 24, 2017, analysts are expecting Domino’s stock price to reach $194.75 in the next 12 months, which represents a return potential of 8.6%. Before the announcement of 4Q16 earnings, analysts had forecasted a price target of $175.40.

The initiatives undertaken by Domino’s management to drive its same-store sales growth could have compelled analysts to raise their price targets.

Below are the return potentials of Domino’s peers over the next 12 months.

Analysts’ recommendations

Of the 19 analysts that follow Domino’s, 36.8% recommend “buy” and 63.2% recommend “hold.” None of the analysts recommend “sell.”

Domino’s stock tends to move in tandem with analysts’ recommendations. If analysts raise their price target, the company’s stock tends to move up and vice versa. Also, a stock price lower than target price doesn’t mean an automatic “buy.” Investors have to carefully analyze various factors, such as the ones we’ve discussed in this series, before making any investment decisions.