Dow Chemical’s Consumer Solutions Segment Revenue Rose in 1Q17

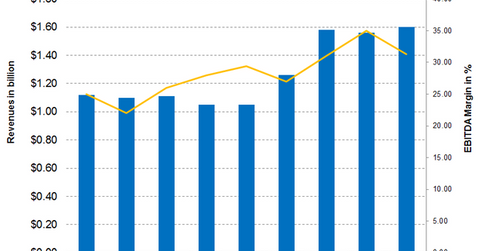

Dow Chemical’s (DOW) Consumer Solutions segment reported revenue of $1.6 billion in 1Q17, a 51.7% rise year-over-year compared to $1.1 billion in 1Q16.

May 1 2017, Updated 7:38 a.m. ET

Dow Chemical’s Consumer Solutions segment’s performance

Dow Chemical’s (DOW) Consumer Solutions segment reported revenue of $1.6 billion in 1Q17, a 51.7% rise year-over-year compared to $1.1 billion in 1Q16. The segment accounted for 12.1% of DOW’s total revenue compared to 9.8% in 1Q16, representing a rise of 2.3 percentage points year-over-year.

DOW’s Consumer Solutions segment reported an operating EBITDA (earnings before interest, tax, depreciation, and amortization) of $500.0 million in 1Q17, a 61.3% rise year-over-year compared to $310.0 million in 1Q16. The segment’s operating EBITDA margin also rose 31.3% in 1Q17 compared to 29.4% year-over-year, representing a margin growth of 190 basis points.

Driving factors

Volumes across all businesses in this segment rose. The primary driver was mainly the inclusion of the silicones business as part of the integration of the Dow-Corning (GLW) acquisition. The upward trend in the automotive business remained intact, driven by growth in emerging markets, specifically led by China, Mexico, and Brazil. Also, new business wins across the portfolio drove up revenues. Finally, the equity earnings from the HSC Group doubled to $40.0 million in 1Q17 compared to $20.0 million in 1Q16.

On the other hand, the divestiture of SAFECHEM dented the segment’s revenues marginally. The segment’s operating EBITDA and EBITDA margin growth were led by synergy effects from the Dow-Corning integration.

Segment’s outlook

The Dow-Corning silicone business will continue to drive the segment. However, DOW expects the upward trend in the automotive industry to continue, which could result in higher sales volumes. The synergy effect from the Dow-Corning integration will drive the segment’s EBITDA.

You can indirectly hold Dow Chemical by investing in the Vanguard Materials ETF (VAW), which has invested 8.4% of its portfolio in Dow Chemical. The other top holdings of the fund include DuPont (DD), Monsanto (MON), and Praxair (PX) with weights of 8.3%, 6.0%, and 4.2%, respectively, as of April 27, 2017.

In the next part, we’ll analyze the performance of Dow Chemical’s Infrastructure Solutions segment in 1Q17.