Can AK Steel Regain Its Lost Mojo in 1Q17?

Previously, we looked at AK Steel’s (AKS) 1Q17 earnings estimates. In this article, we’ll look at some key updates the markets could be anticipating in the company’s 1Q17 earnings call.

April 17 2017, Updated 10:36 a.m. ET

AK Steel’s 1Q17 earnings call

Previously, we looked at AK Steel’s (AKS) 1Q17 earnings estimates. In this article, we’ll look at some key updates the markets could be anticipating in the company’s 1Q17 earnings call.

AK Steel has been among the worst-performing steel companies in 2017. The stock has fallen more than 35% in 2017 based on its April 12, 2017, closing price. Furthermore, AK Steel’s stock price is now at its lowest level since November 8, 2016. The stock has lost the gains it built up after President Donald Trump’s election.

Automotive sector

Automotive companies account for a large chunk of AK Steel’s sales. Note that ArcelorMittal (MT) is the leading global steel supplier to the automotive sector. U.S. Steel Corporation (X) and Nucor (NUE) also supply steel to the automotive sector.

US auto sales have fallen year-over-year in 1Q17. Lower auto build rates are negative for AK Steel. During AK Steel’s 1Q17 earnings call, markets will be listening for its management’s commentary on the auto sector’s outlook.

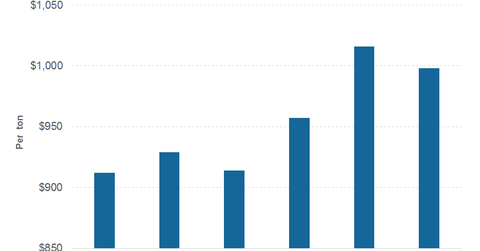

Average selling prices

The markets (MDY) (MID-INDEX) will also be looking for clues about AK Steel’s average selling price (or ASP) guidance. During its 4Q16 call, AK Steel spooked the markets with its 1Q17 ASP guidance. The company’s ASP guidance is crucial, as it will likely affect the company’s profitability in the coming quarters.

You can visit Market Realist’s Steel page for ongoing updates on the steel industry. You can also check out China or Trump: What Could Drive Steel Companies in 2017? to explore recent steel industry indicators.