Costco on the Street: Analyst Recommendations

Of the 32 analysts covering Costco (COST), 69.0% have rated the stock as a “buy” as of April 5. The stock has been rated as a “hold” by 31% of these analysts.

Nov. 20 2020, Updated 3:33 p.m. ET

Analysts seem positive about Costco

Of the 32 analysts covering Costco Wholesale (COST), 69.0% have rated the stock as a “buy” as of April 5. The stock has been rated as a “hold” by 31% of the analysts, but none of the analysts have a “sell” rating on the stock.

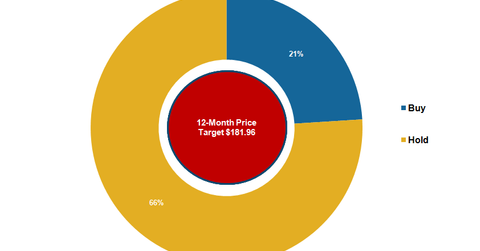

On April 5, Costco was trading at $167.00, which is 8.2% below the analysts’ 12-month price target of $181.96 per share.

Peer comparisons

Of the 36 analysts covering Wal-Mart Stores (WMT), 31% have recommended a “buy” on the stock, while 58.0% have recommended a “hold,” and 11.0% have rated it as a “sell.”

For Target (TGT), 21.0% of the 29 analysts have rated the stock as a “buy,” while 66.0% have rated it as a “hold,” and 14.0% have rated it as a “sell.”

Of the 27 analysts covering Dollar Tree (DLTR), 48% have recommended a “buy” on the stock, while 44.0% have recommended a “hold,” and 7.0% have rated it as a “sell.”

Valuation summaries

Costco is currently trading at a one-year forward PE (price-to-earnings) of 27.4x (as of April 5, 2017). This means that it is operating closer to the higher end of its 52-week PE range of 23.5x–28.6x and that it is still trading at a premium as compared to competitors Walmart and Target, which are currently valued at 16.5x, and 13.2x, respectively.

Given Costco’s strong sales results and ability to drive store traffic—not to mention its strong fundamentals, recently announced membership fee hike, and growth prospects—the company’s premium valuation seems warranted. Analysts expect Costco to report a 7% increase in sales for fiscal 2017, while its bottom line is expected to register a growth of 6.2%.

Notably, investors looking for indirect exposure to Costco might consider ETFs like the VanEck Vectors Retail ETF (RTH), which invests 5.4% of its portfolio in the company.

For more updates, please visit Market Realist’s Consumer Discretionary page.