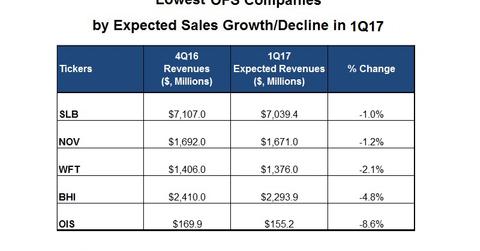

Worst Oilfield Services Stocks for 1Q17 by Revenue Growth

Weatherford International (WFT) is expected to witness a 2.1% fall in revenue in 1Q17 compared to 4Q16.

March 23 2017, Updated 6:05 p.m. ET

Will Oil States International be the laggard in revenue growth?

Wall Street analysts expect Oil States International (OIS) to see the steepest fall in revenue among our OFS (oilfield services and equipment) group. OIS could see an 8.6% fall in revenue in 1Q17 compared to 4Q16.

OIS management expects a lower backlog and delays in its offshore energy projects. But management also expects revenues from its Well Site Services segment to improve in 1Q17, driven by growing completions activity as a result of strong US shale activities. OIS makes up 0.10% of the SPDR S&P MidCap 400 ETF (MDY).

WFT’s and NOV’s expected falls in revenue

Weatherford International (WFT) is expected to witness a 2.1% fall in revenue in 1Q17 compared to 4Q16. WFT expects the suspension of its US pressure pumping activity and lower product sales to cause its 1Q17 revenue to fall. WFT management also expects a seasonal weakness across the North Sea and Russia.

Analysts expect National Oilwell Varco’s (NOV) revenue to fall 1.2% in 1Q17 compared to 4Q16. NOV management expects the offshore energy market and parts of its international operations to remain challenging in 2017. Its capital equipment sales have been weak as a result of the downturn in the energy market. You can read more about NOV in Market Realist’s Is National Oilwell Varco’s Stock Price Gaining Steam?

By comparison, Wall Street analysts expect Baker Hughes’s (BHI) revenue to fall 4.8% in 1Q17 compared to 4Q16.

Next, we’ll take a look at the top five OFS companies by expected EBITDA (earnings before interest, tax, depreciation, and amortization) growth in 1Q17.