Will Congress Reset Debt Levels?

The CBO expects the budget deficit to remain below 3% of GDP until 2019.

March 28 2017, Published 12:46 p.m. ET

VanEck

BUTCHER: What should investors be looking for in 2017?

VAN ECK: A key question is whether Congress will fix the U.S.’s long-term debt problem. If it doesn’t, our entitlement systems like Social Security and Medicare will likely go bankrupt in 15 years. If they bend the yield curve, I can see rates going higher, which is good in a way because bullishness will continue.

Market Realist

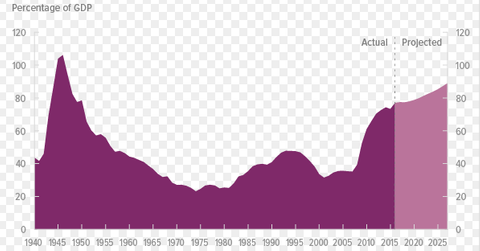

In this part of the series, we’ll discuss the US’s current debt level, the role of Congress in debt determination, and the future projected debt level.

What is the US’s current debt position?

Congress needs to reset its debt limit to $20 trillion. If not, it might have to forego payment for plans like social security or Medicare. If Congress doesn’t reset the ceiling, then it might have to resort to other measures like the termination of the sale of government bonds. The Treasury Department’s power to borrow money expired on March 16. The debt limit has been reset 44 times under Republican presidents and 39 times under Democrats. Treasury Secretary Steven Mnuchin already pleaded for a lift in the debt ceiling. He has also requested the suspension of the sale of government bonds to control the debt level.

Consequences of a debt default

We are well aware of the consequences of a debt default. If the government fails to repay the Treasury bondholder, then the bond value will rise. It will also entail a higher return for investors for the risk involved due to the lost faith in the US dollar. Ultimately, a default could lead to rising interest rates on a worldwide basis.

Debt projections

The CBO expects the budget deficit to remain below 3% of GDP until 2019. The deficit is being projected to reach 5% of GDP by 2027 due to increased expenditure on social security, Medicaid, and interest payments. CBO has projected a growth of 67% in public debt to $25 trillion (or 89% of GDP) between 2017 and 2027. Donald Trump is yet to divulge how he intends to finance his ambitious infrastructure (IGF) (INXX) and tax plans, which could increase debt levels further.

Potential Fed hike will make investment-grade bonds popular

If the Fed goes ahead with its rate hikes in response to rising inflation, we’ll likely see a further increase in short-term yields, which means investors will likely flock towards risk-free assets.

Thus, BlackRock posits that expensive investment-grade bonds (HYHG) (HYGH) won’t lose their popularity due to rising volatility associated with further tightening by the Fed.