What Analysts Recommend for PPG Industries

As of March 23, 2017, 21 brokerage firms were actively tracking PPG Industries (PPG) stock.

March 23 2017, Updated 12:05 p.m. ET

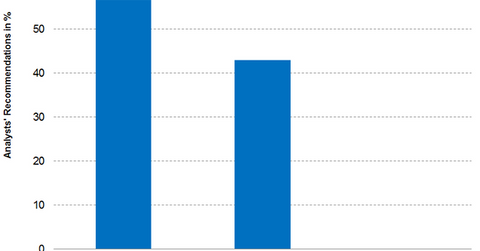

Analyst recommendations for PPG Industries

As of March 23, 2017, 21 brokerage firms were actively tracking PPG Industries (PPG) stock. About 57.0% of them have recommended a “buy” for the stock, and 43.0% have recommended a “hold.” None of the analysts have recommended a “sell.”

The analyst consensus for PPG’s 12-month target price is $111.75, which implies a return potential of 7.2% from its closing price of $104.25 on March 22, 2017.

Why many analysts are recommending a “buy”

PPG Industries’ new cost restructuring program with an aim to save $125.0 million in annual costs is expected to improve its earnings in the coming period. Plus, PPG is expected to use $2.5 billion–$3.5 billion in cash for acquisitions and share repurchases between 2017 and 2018, which would help future revenue growth.

Recommendations and price targets

Below are some of the recommended target prices for PPG Industries from some well-known brokerage firms:

- On March 17, 2017, Atlantic Capital rated PPG Industries as “overweight” with a target price of $125. The target implies a 12-month potential return of 19.9% from its closing price of $104.25 on March 22, 2017.

- On March 10, 2017, JPMorgan Chase (JPM) rated PPG Industries as “overweight” with a target price of $110. The target implies a 12-month potential return of 5.5% from its closing price of $104.25 on March 22, 2017.

- On February 14, 2017, Evercore Partners (EVR) rated PPG Industries a “buy” with a target price of $117. The target implies a 12-month potential return of 12.2% from its closing price of $104.25 on March 22, 2017.

You can indirectly hold PPG Industries by investing in the Vanguard Materials ETF (VAW), which has invested 3.3% of its portfolio in PPG Industries. One of the fund’s top holdings is Dow Chemical (DOW), which had a weight of 8.4% as of March 22, 2017.