Target Stock Plunges after 4Q16 Earnings and Revenue Miss

Target (TGT), the third-largest mass merchandiser in the US, declared results for 4Q16 on February 28, 2017.

March 1 2017, Updated 6:19 p.m. ET

Summary

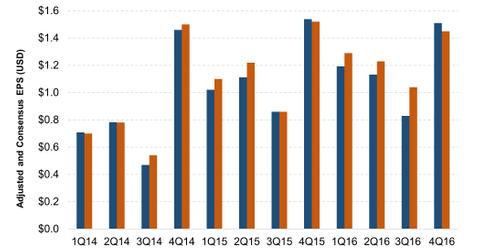

Target (TGT), the third-largest mass merchandiser in the US, declared results for 4Q16 and full fiscal results on February 28, 2017. The company failed to meet Wall Street expectations on earnings as well as revenues. Earnings per share fell 4.6% YoY (year-over-year) to $1.45, missing the consensus estimates by six cents.

Total revenue fell 4.3% YoY to $20.69 billion. On average, Wall Street was expecting total sales to fall 4.1% YoY to $20.75 billion. The current quarter marked the sixth consecutive quarterly decline in the company’s sales. Read the next article to find out the reasons behind the 4Q16 sales miss.

Stock market reaction to 4Q16 results

Target’s stock plunged as the company reported disappointing results and gloomy guidance. The stock price crashed 12% to close at $58.77 on February 28.

Valuations summary

Target is currently trading at a one-year forward earnings multiple of 12.8x as of February 28, 2017. It’s operating closer to the lower end of its 52-week price-to-earnings (or PE) range of 12.2x to 15.9x.

The company continues to trade at a discount to competitors Walmart (WMT) and Costco (COST), which are valued at 16.4x and 29.2x, respectively. It’s also cheaper compared to supermarket Kroger (KR) at 15.1x and discount store chain Dollar Tree (DLTR) at 18.2x.

About Target

Founded in 1902, Target (TGT) is the 11th largest retailer in the world in terms of sales. The company operates 1,802 stores in the US as of January 2017, selling a variety of merchandise including apparel, electronics, toys, food, and groceries.

The company clocked sales of $69.6 billion over the last 12 months (or LTM). Walmart, its competitor and world’s largest retailer, has LTM sales of $486 billion.

Investors looking for exposure to Target through ETFs can invest in the VanEck Vector Retail ETF (RTH), which invests 3.8% of its total holdings in the company.