Dollar General to Post Strong 2016 Top Line Compared to Peers

Dollar General’s total sales rose around 6% YoY (year-over-year) to $16 billion in the first nine months of 2016.

March 10 2017, Updated 10:36 a.m. ET

Evaluating Dollar General’s top-line performance

Dollar General (DG), America’s leading discount store operator, is slated to report 4Q results on March 16. The company’s total sales rose around 6% YoY (year-over-year) to $16 billion in the first nine months of 2016. For the fourth quarter, Wall Street is expecting a 12.9% YoY jump in sales to $6.0 billion. The retailer fell short of the Wall Street revenue estimates in all three quarters of 2016. The primary reason for this shortfall has been a slowdown in the company’s same-store sales.

What’s behind slowing sales comps?

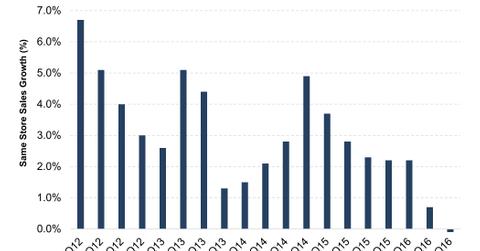

Dollar General has witnessed a deterioration in sales comps over the last two years. In fiscal 2016, comps plunged from 2.2% in the first quarter to 0.7% in Q2 and entered the red with a 0.1% decline in Q3.

The third quarter marked the end of the positive comps spree that the company had maintained for the last 36 consecutive quarters. The management blamed the ongoing deflation in food products and a reduction in SNAP benefits as the key reasons for slowing sales comps.

Investors looking for exposure to Dollar General through ETFs can consider the Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF (RCD), which invests 1.2% of its total holdings in the company.

Growth estimates for full fiscal 2016

For full fiscal 2016, the company’s sales are likely to land at $22 billion, up 7.9% YoY. The majority of this increase is coming from new store openings. The company had a target of opening 900 new stores in fiscal 2016. As we discussed, Dollar General’s same-store sales have been quite lackluster. Year-to-date comps have grown by only 0.9%.

Despite slowing comps, the company is likely to deliver best-in-class top-line numbers. In comparison, Dollar Tree (DLTR) recorded top-line growth of 5% when it reported full-year results on March 1.

Retail heavyweight Walmart (WMT) and supermarket giant Kroger (KR) reported full-year sales growths of 0.8% and 5%, respectively, when they reported results recently.

Read the next section to know about the company’s profitability and margins.