Behind Norfolk Southern’s Intermodal Volumes in the 8th Week

NSC’s total intermodal traffic rose 4.3% in the week ended February 25, 2017, reaching ~78,000 containers and trailers.

March 6 2017, Updated 4:05 p.m. ET

Norfolk Southern’s intermodal volumes

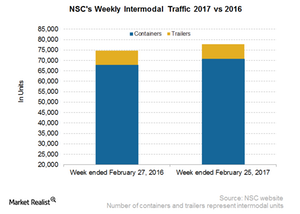

Norfolk Southern’s (NSC) total intermodal traffic rose 4.3% in the week ended February 25, 2017. Volumes reached nearly 78,000 containers and trailers, as compared to ~75,000 in the week ended February 27, 2016.

Notably, trailers followed containers in terms of percentage increase. NSC’s container traffic rose 4.3% YoY (year-over-year), up from 68,000 units in the week ended February 27, 2016, to ~71,000 units. NSC’s percentage rise in intermodal volumes was in contrast with the percentage fall reported by US railroads.

NSC’s trailer traffic grew 2.7% YoY, in the eighth week of 2017. Since the beginning of 2017, NSC’s overall intermodal traffic has risen 3.8% YoY.

Why is intermodal vital for NSC?

NSC’s rise in trailer volumes appears to mark the end of its hardship due to the restructuring of TCS (Triple Crown Services), an underperforming subsidiary. NSC has been shifting shippers to other intermodal lanes. The restructured TCS intends to focus on specific merchandise such as auto parts (TM).

Remember, the intermodal businesses of all major US railroads face strong competition from the trucking industry (JBHT). Although railroads are four times more fuel efficient than trucks, the fall in fuel prices in 2016 made truckers more competitive.

Electronic logging devices

Meanwhile, the implementation of ELDs (electronic logging devices) in the trucking industry will most likely create service issues, thereby tightening truck capacity (KNX). With the tightening of the trucking market in 2017, intermodal should stand to benefit, according to Norfolk Southern.

With fuel prices on the rise again, intermodal volumes should rise in coming quarters. This rise will likely be due to the cost-efficient nature of railroads on medium and long hauls, where trucking will be less lucrative.

Investing in ETFs

Railroads make up part of the industrial sector. If you want exposure to the transportation and logistics sector, you can invest in the First Trust Industrials/Producer Durables AlphaDEX ETF (FXR). FXR’s portfolio holdings include major US airlines and railroads.

In the next part, we’ll look at the rail traffic of Norfolk Southern’s competitor, CSX (CSX).