Are Rising Chinese Steel Inventories a Risk for Steel Investors?

With higher steel production and subdued demand, one would expect a tsunami of Chinese steel exports, but this wasn’t the case last month. So what did China want with so much steel?

March 7 2017, Updated 7:35 a.m. ET

Chinese steel inventories

As noted earlier in the series, China’s steel production rose 7.4% year-over-year (or YoY) in January 2017, while its steel exports fell 23.8% during the same period. The country’s steel demand was likely lower in the month compared to the corresponding month in 2016 due to the early Chinese New Year holidays in 2017.

With higher steel production and subdued demand, one would expect a tsunami of Chinese steel exports, but this wasn’t the case last month. So what did China want with so much steel (X) (AKS)?

Inventory rises

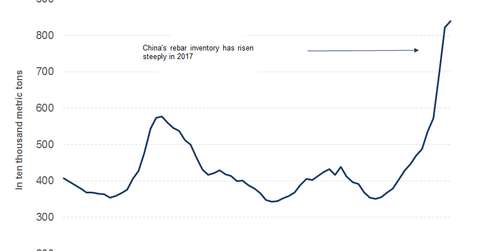

China’s steel inventory has surged so far in 2017. According to SteelHome, hot rolled coil (or HRC) inventories have risen ~1 million metric tons in China so far in the year, while rebar (or reinforcing bar) inventory has risen more than 4 million metric tons. For now, China seems to be stocking its excess steel production in the absence of comparable end user demand.

Note that rebar and HRC are among the most widely used steel products. Inventory restocking can only provide momentary relief to steel prices. Metals prices (DBC) depend on underlying real demand and supply.

What to look for

The demand-supply mismatch could hamper a sustained recovery in Chinese steel prices. The Chinese government may need to intensify its efforts to curtail excess steel capacity. If Chinese steel production continues to grow unabated, it could hamper the steel industry’s nascent recovery.

In the next article, we’ll see what US demand indicators suggest for steelmakers (NUE) (MT).