Under Armour Stock Lost 29% during the Week after Its 4Q16 Results

Under Armour (UAA), which is covered by 35 Wall Street analysts, has ten “buy” recommendations, four “sell” recommendations, and 21 “hold” recommendations.

Feb. 7 2017, Updated 4:05 p.m. ET

Under Armour lost 29% this week

Under Armour (UAA) had a tough week after it reported lower-than-expected 4Q16 results, as well as gloomy guidance for fiscal 2017. UAA stock fell 25% after it released its 4Q16 results on Tuesday, January 31, 2017.

UAA’s unimpressive results were followed by a glut of analyst downgrades along with a credit rating revision by S&P Global Ratings. As we discussed in the previous part, S&P Global Ratings lowered the company’s debt from BBB- to BB+, putting it in the junk category.

Under Armour (UAA) stock has lost ~28.8% over the last week. UAA is now trading 133% below its 52-week-high price and is sitting at year-to-date losses of 29%. UAA is among the worst-performing S&P 500 stocks this year and is trading at three-year lows.

Analyst recommendations on UAA

Wells Fargo, Susquehanna, BofA Merrill Lynch, Canaccord Genuity, B. Riley, Piper Jaffray, Evercore ISI, and Credit Suisse downgraded Under Armour stock last week. These companies cited slowing growth, high inventory, and the CFO’s sudden departure as the key reasons behind the downgrade.

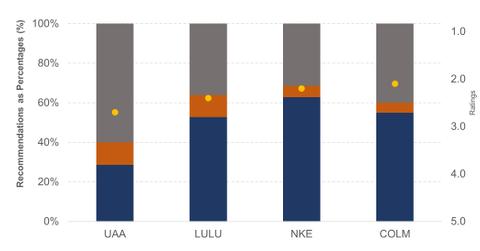

Under Armour (UAA), which is covered by 35 Wall Street analysts, has ten “buy” recommendations, four “sell” recommendations, and 21 “hold” recommendations.

Under Armour stock holds a 2.7 rating on a scale of 1 (strong buy) to 5 (sell). UAA has a lower rating than its peers Lululemon Athletica (LULU), Columbia Sportswear (COLM), and Nike (NKE), which received analyst ratings of 2.4, 2.1, and 2.2, respectively.

The average price target for UAA stock is $23.50, indicating an upside of ~14% over the next year. Nike and Columbia Sportswear have better upsides of 17% and 21%, respectively.

ETF investors seeking to add exposure to UAA can consider the iShares US Consumer Goods ETF (IYK), which invests 0.32% of its portfolio in the company.