Mondelēz’s Stock: Why Do Most Analysts Rate It a ‘Buy’?

Current recommendations As of January 30, 15 of 20 analysts covering Mondelēz International’s stock had a “buy” rating. Five analysts had a “hold” recommendation, and there were no “sell” recommendations. On January 5, 2017, Berenberg Bank initiated coverage on Mondelēz International’s stock with a “buy” rating and a price target of $51. Consensus “buy” rating […]

Nov. 20 2020, Updated 11:27 a.m. ET

Current recommendations

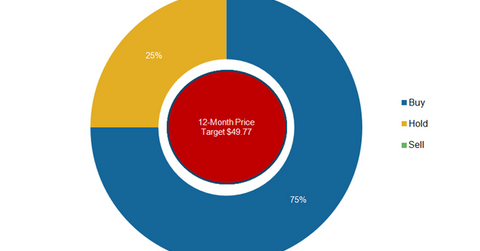

As of January 30, 15 of 20 analysts covering Mondelēz International’s stock had a “buy” rating. Five analysts had a “hold” recommendation, and there were no “sell” recommendations. On January 5, 2017, Berenberg Bank initiated coverage on Mondelēz International’s stock with a “buy” rating and a price target of $51.

Consensus “buy” rating

Despite persistent weakness in Mondelēz International’s sales, most analysts rate it as a “buy” due to its strong product portfolio and extensive international presence. The company owns several popular brands, including Oreo, Cadbury, and Trident. The company is currently under pressure due to currency headwinds, a slowdown in certain key markets, and the growing aversion toward high-sugar content products.

Mondelēz is trying to revive its business through cost control, productivity measures, and innovation. The company is focusing on high-growth core businesses and divesting non-core operations. On January 18, the company announced its decision to sell most of its grocery business in Australia and New Zealand to Bega Cheese.

In September 2016, the company announced its intention to invest $65 million in global research and development hubs. The company is focusing on innovation through healthier snacks, with lower salt and fat content. The company intends to have 50% of its portfolio in the well-being space by 2020. Rival The Hershey Company (HSY) is also focusing on innovation and launched its new Cookie Layer Crunch bars in December 2016. Mondelēz International constitutes 5.2% of the PowerShares Dynamic Food & Beverage ETF (PBJ).

12-month price target

As of January 30, the 12-month price target for Mondelēz International stock was $49.77. This price estimate reflects an upside potential of 12.0% based on the company’s closing stock price of $44.43 on January 30. As mentioned in the first part of this series, Mondelēz’s stock has risen 0.2% since the start of 2017. The company’s upcoming 4Q16 results on February 7 and its fiscal 2017 guidance may result in changes in analysts’ recommendations and price targets. For more updates, visit our Consumer Products page.