Key Drivers of VF Corporation’s Top Line in Fiscal 4Q16

VF Corporation’s D2C revenues rose 11% YoY, gaining strength from a mid-teen surge in the Outdoor & Action Sports and a low double-digit rise in Jeanswear.

Feb. 23 2017, Updated 12:34 p.m. ET

What were VFC’s key revenue drivers during fiscal 4Q16?

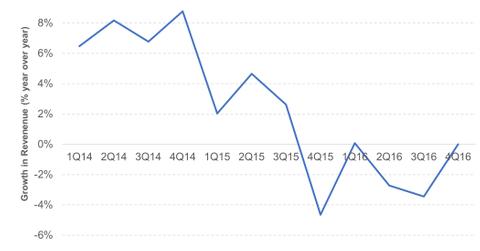

As we discussed earlier in this series, VF Corporation (VFC) reported its fiscal 4Q16[1. quarter ended January 31, 2017] results on February 17, 2017. As demonstrated in the last several quarters, the company’s top line was driven by its robust international business and steady direct-to-customer (or D2C) channel.

VF Corporation’s D2C revenues rose 11% YoY, gaining strength from a mid-teen surge in the Outdoor & Action Sports and a low double-digit rise in Jeanswear. VFC’s E-Commerce segment was particularly strong, recording 21% growth during the quarter.

VFC peers

Other apparel and accessory companies have also reported strong growth in their e-commerce sales. For example, Kate Spade & Co. (KATE) reported sales comps of 9.3% in 4Q16. Most of the improvement in comps was driven by the company’s robust e-commerce sales. Excluding e-commerce, KATE’s sale comps rose ~1.5%.

As in the last couple of quarters, KATE’s Wholesale channel remained in a lull. Revenues from this channel displayed a mid-single-digit decline, primarily due to a slowdown in its America Jeanswear business, retail bankruptcies, and reductions in inventory.

Investors who want exposure to VFC can consider the First Trust Rising Dividend Achievers ETF (RDVY), which invests ~1.9% of its portfolio in VFC.

International sales continue their strong momentum

VF Corporation’s international revenues rose 5% YoY, driven by a 6% increase each in Europe, China, and the Asia-Pacific regions. Its international D2C channel remained particularly robust, growing at a mid-teen rate during the quarter.

Among VFC’s competitors, PVH Corp (PVH) also reported stronger international sales compared to its domestic sales. The company’s Calvin Klein brand recorded international retail comps growth of 7% compared to a 4% decline in North America.

You can read more about the performance of the company’s various business segments in the next article.