Is Secure Identification Solutions a Dying Segment for NXP?

The SIS segment’s revenues fell 11% sequentially in fiscal 3Q16 and is expected to fall another 14% to 16% in fiscal 4Q16 to ~$151.3 million.

Feb. 6 2017, Updated 7:36 a.m. ET

NXP’s Secure Identification Solutions segment

In the previous part of this series, we saw that NXP Semiconductors’s (NXPI) Secure Connected Devices and Secure Interface and Infrastructure segments are likely to report seasonal weakness in fiscal 4Q16 but could continue to grow in fiscal 2017.

One segment where growth is likely to stall is the SIS (Secure Identification Solutions) segment, which accounted for 7.2% of NXP’s 3Q16 revenue. The SIS business delivers security and privacy solutions to the banking, transportation, and e-government markets.

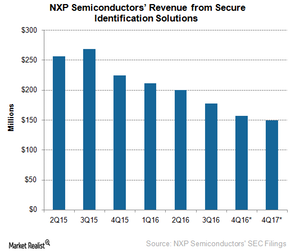

SIS revenue trend

The SIS segment has been reporting continuous revenue declines since fiscal 4Q15, as the growth in the e-government market could not offset the declines from China’s (FXI) bank card market. Moreover, NXPI has been selective in choosing its customers to comply with competitive practices and activities, which further reduced its revenue.

The SIS segment’s revenues fell 11% sequentially in fiscal 3Q16 and is expected to fall another 14% to 16% in fiscal 4Q16 to ~$151.3 million. However, NXP Semiconductors (NXPI) expects SIS revenue to moderate to ~$150 million by fiscal 4Q17 as the e-government market presents new growth opportunities. The only growth coming from banking would be the replacement cards which would not be able to replicate the earlier growth rate.

NXP Semiconductors sees strong growth opportunity arising from the e-government, especially ePassport. Next, we will look at the trend in ePassport and the opportunities it could bring for NXP Semiconductors.