How Broadcom’s Acquisitions Could Improve Its Profitability

Broadcom’s profitability In the previous part of this series, we saw that Broadcom (AVGO) is likely to witness seasonal revenue decline as demand in its wireless segment, its second largest, falls. While revenue depends significantly on external factors such as customer demand, the pricing environment, and competition, profitability depends on internal factors such as cost control and product […]

Dec. 4 2020, Updated 10:53 a.m. ET

Broadcom’s profitability

In the previous part of this series, we saw that Broadcom (AVGO) is likely to witness seasonal revenue decline as demand in its wireless segment, its second largest, falls. While revenue depends significantly on external factors such as customer demand, the pricing environment, and competition, profitability depends on internal factors such as cost control and product mix.

Broadcom is likely to report wide profit margins in fiscal 1Q17 as it realizes cost synergies from the Avago-Broadcom merger. The company is aiming for capital expenditure of $200 million to bring expensive tests in-house, which could significantly reduce its material costs and improve its margins.

Gross margin estimates

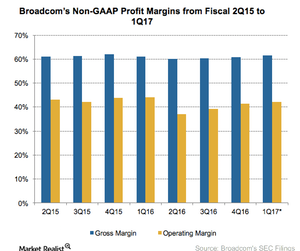

Broadcom’s non-GAAP (generally accepted accounting principles) gross margin narrowed to 60% after the Avago-Broadcom merger. The combined company improved its margin to 60.8% in fiscal 4Q16 through operational efficiency. The company expects to further improve the margin to 61.5% in fiscal 1Q17, which is slightly narrower than Intel’s (INTC) and Texas Instruments’ (TXN) gross margins of 63.1% and 62.5%, respectively. In the long term, Broadcom expects to maintain its gross margin at around 60%.

Operating margin estimates

Broadcom has been reducing its opex (operating expenses) as it realizes merger synergies. The company expects its opex to fall 2.2% sequentially to $785 million in fiscal 1Q17. This fall could result in a non-GAAP operating margin of 42.2% in fiscal 1Q17, wider than the fiscal 4Q16 margin of 41.5%.

Broadcom’s operating margin is wider than Intel’s, Texas Instruments’, and Qualcomm’s (QCOM) margins of 29.9%, 38.8%, and 35%, respectively. These rivals have high opex. Intel, Texas Instruments, and Qualcomm spend 33%, 24%, and 26% of their revenue on opex, whereas Broadcom spends only 19.4% of its revenue on opex. Broadcom aims to maintain its opex margin at around 20% in the long term and thereby improve its operating margin to 45% as it realizes material cost synergies and benefits from a larger scale.

The Brocade Communications Systems (BRCD) deal could add $900 million in EBITDA (earnings before interest, tax, depreciation, and amortization) in fiscal 2018, which would help Broadcom achieve its 45% target margin. Broadcom believes that it can achieve the target margin even without Brocade—it may just take longer to reach the target. In the next few parts of this series, we’ll look at Broadcom’s four business segments and the factors driving growth in each of them.