How a Verizon-Charter Deal Could Impact the US Pay-TV Space

The potential acquisition of Charter Communications (CHTR) could be seen as another attempt by Verizon (VZ) to pursue revenue growth outside its traditional carrier business.

Feb. 17 2017, Updated 7:36 a.m. ET

US pay-TV space

The potential acquisition of Charter Communications (CHTR) could be seen as another attempt by Verizon (VZ) to pursue revenue growth outside its traditional carrier business, in which competition has become more intense. Smaller carriers T-Mobile (TMUS) and Sprint (S) have stepped up the competition for subscribers via aggressive pricing techniques.

Through a Charter acquisition, Verizon could grow to be the size of AT&T (T), with ~60 million home passings. If Verizon does acquire Charter, the combination could also create a strong competitor for Comcast (CMCSA) in the 5G (fifth-generation) technology and US pay-TV spaces.

OTT market

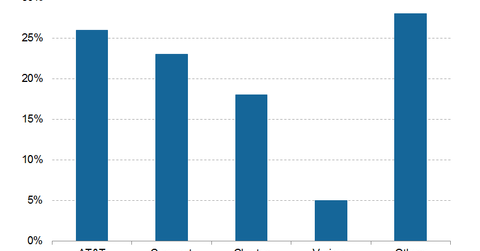

Earlier, through its DIRECTV acquisition, AT&T became the leading pay-TV player in the United States. After this deal, at the end of 4Q16, AT&T’s US pay-TV subscriber base reached 25.3 million, surpassing Comcast’s subscriber base. Comcast stood in second place at 22.5 million pay-TV subscribers. Charter ranked third with ~16.9 million pay-TV subscribers.

However, according to reports, pay-TV providers such as Verizon, Comcast, and Charter are currently losing customers to online video streaming companies via a phenomenon known as cord-cutting.

The over-the-top (or OTT) video streaming market has huge growth potential. Users have been subscribing to OTT services in greater numbers than ever before, mainly due to the high monthly bills that users are paying cable and satellite TV providers. A 3Q16 report from Digitalsmiths suggests that ~35.0% of users pay more than $100 every month to their pay-TV providers.

The online video streaming market in the United States is crowded. Currently, the major players in the market are Netflix (NFLX), DISH TV’s (DISH) Sling TV, and Sony’s (SNE) PlayStation Vue.