What Hampered Under Armour’s 4Q16 Profitability?

In 4Q16, Under Armour’s adjusted earnings per diluted share stood at $0.23, which was $0.02 lower than what analysts were expecting.

Feb. 6 2017, Updated 7:37 a.m. ET

Under Armour’s 4Q16 margins

Under Armour (UAA) had a tough 4Q16, missing both its top-line and bottom-line estimates. We’ve discussed the reasons behind the company’s top-line miss in the previous parts of this series. Now let’s focus on the company’s margins and profitability.

What drove the 4Q16 earnings miss?

In 4Q16, Under Armour’s adjusted earnings per diluted share stood at $0.23, which was $0.02 lower than what analysts were expecting. EPS fell 4% YoY (year-over-year), primarily driven by lower revenues, a fall in gross margin, and higher SG&A (selling, general, and administrative) rates.

Rival Nike (NKE), however, delivered a strong most recent quarter, with EPS rising 11% YoY, beating the consensus by $0.07. Competitor Lululemon Athletica (LULU) also posted a solid bottom-line performance. LULU’s EPS rose 34% YoY to $0.47 per share, beating the consensus by $0.04.

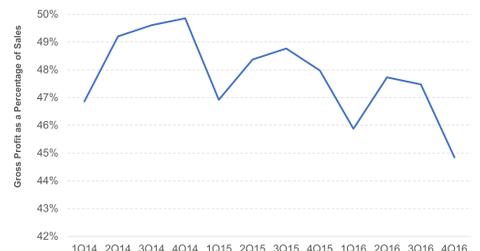

Inside UAA’s gross margins

UAA’s 4Q16 gross margin fell ~320 basis points to 44.8%, with gains from more favorable product costs offset by aggressive inventory management, foreign exchange effects, and a higher mix of footwear and international businesses, which typically have lower margins than apparel and North America segments.

Operating margin

A lower gross margin, along with a 9% rise in SG&A expenses, led to a 6% fall in UAA’s operating profit, which came in at $167 million. Higher SG&A expenses resulted from continued investments in the company’s footwear, international, and DTC segments. Its net income fell 1% YoY to $105 million in 4Q16.

ETF investors seeking exposure to UAA can consider the iShares Russell Mid-Cap Growth ETF (IWP), which invests 0.20% of its portfolio in the company.

For more on Under Armour’s revised guidance, continue to the next article of this series.