How Did Juniper Networks Perform in 3Q16?

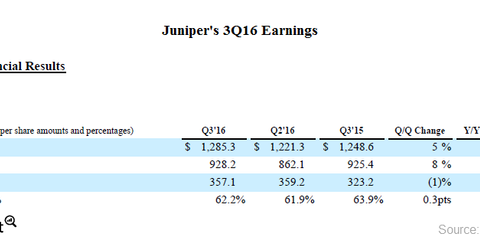

Juniper Networks (JNPR) announced its 3Q16 results on October 25, 2016, and reported revenues of ~$1.3 billion. Revenues rose 5% sequentially quarter-over-quarter and 3% year-over-year.

Oct. 31 2016, Updated 8:06 a.m. ET

3Q16 revenues

Juniper Networks (JNPR) announced its 3Q16 results on October 25, 2016, and reported revenues of ~$1.3 billion. Revenues rose 5% sequentially (quarter-over-quarter) and 3% YoY (year-over-year). Juniper’s GAAP[1. generally accepted accounting principles] operating margin for 3Q16 was 19.5%, compared to 20.7% in 3Q15 and 16.7% in 2Q16.

Non-GAAP net income was $222 million, and its EPS (earnings per share) came in at $0.58 per diluted share in 3Q16.

What did analysts expect in 3Q16 for Juniper?

Analysts estimated that Juniper Networks (JNPR) would post revenues of $1.26 billion for the quarter that ended September 30, 2016, with a low estimate of $1.24 billion and a high estimate of $1.28 billion. Its EPS are estimated at $0.52, with a high estimate of $0.56 and a low estimate of $0.49.

“I am pleased to report a solid quarter of revenue growth and operating performance. We are executing well on our strategy, with a product and innovation pipeline that has never been stronger,” said Rami Rahim, Juniper Networks’s CEO. “One of the most important trends happening around us is the shift to the cloud, which is shaping our strategy and plays to Juniper’s core competencies in building high-performance networks.”

Shares of JNPR rose 10.2% on October 26, 2016, as the company beat earnings estimates.

Juniper Networks is an industry leader in automated, scalable, and secure networks. It has a market capitalization of $11 billion. In comparison, its peers Cisco Systems (CSCO), Fortinet (FTNT), and Europe’s (FEP) Ericsson (ERIC) have market caps of $153 billion, $5 billion, and $16.5 billion, respectively.