Why Analysts Are Recommending “Buy” for Starbucks

Target price On January 13, 2017, Starbucks (SBUX) was trading at $57.85. The company’s share price may already have been factored into the estimates we’ve discussed in this series. In this article, we’ll look at analysts’ recommendations and estimated target prices for the stock over the next 12 months. Despite Starbucks posting strong 4Q16 earnings […]

Dec. 4 2020, Updated 10:52 a.m. ET

Target price

On January 13, 2017, Starbucks (SBUX) was trading at $57.85. The company’s share price may already have been factored into the estimates we’ve discussed in this series. In this article, we’ll look at analysts’ recommendations and estimated target prices for the stock over the next 12 months.

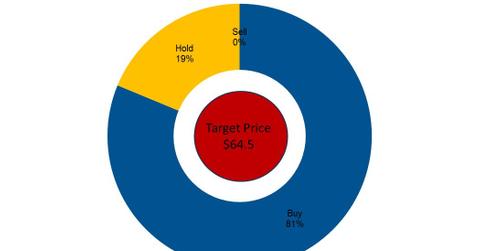

Despite Starbucks posting strong 4Q16 earnings and the measures adopted by the company to improve its same-store sales growth, analysts have not raised their price target. As of January 13, 2017, they expect the stock to reach $64.50 in the next 12 months, which represents a return potential of 11.4%.

The return potential of Starbucks’s peers in the next 12 months is as follows:

Analysts’ recommendations

Of the 32 analysts following Starbucks, 81.2% have given Starbucks “buy” recommendations and 18.8% have given it “hold” recommendations. There have been no “sell” recommendations on the stock. As analysts raise their target prices for the next 12 months, the price of the stock may also rise, and vice versa.

A lower share price—that is, a price that’s lower than a company’s target price—doesn’t mean that a stock is an automatic “buy.” Before investing, make sure to carefully analyze the various metrics we’ve covered in this series.