Prospect Capital’s Higher Leverage Could Impact Returns in 2017

Since the Fed increased interest rates in December 2016, Prospect Capital (PSEC) could see some pressure on its cost of capital in 2017.

Jan. 4 2017, Updated 9:06 a.m. ET

Leverage amid rising rates

Prospect Capital (PSEC) has been operating at a higher leverage to take advantage of low rates. But since the Fed increased interest rates in December 2016, the company could see some pressure on its cost of capital in 2017.

In fiscal 1Q17, Prospect’s net debt-to-equity ratio rose to 76.3% from 69.5% in the previous quarter. The rise was due mainly to a utilization of credit facility on account of higher deployments and investments.

Prospect Capital repaid $167.5 million in convertible notes in August 2016 at maturity. The company can look at the monetization of select investments or equity dilution for fund raising. However, it’s not looking at equity options in the near future due to a discount in stock prices compared to its net asset value.

By comparison, Prospect’s competitors generated the following returns on equity deployment:

Together, these companies make up 1.9% of the PowerShares Global Listed Private Equity ETF (PSP).

Prospect’s balance sheet

Prospect Capital’s cost of debt was approximately 5.0% in fiscal 1Q17. It fell year-over-year, mainly due to the repayment of high-cost debt. In August 2016, the company amended its revolving credit facility to remove some of the restrictions in the definition of an eligible loan. The facility continues to carry an investment-grade rating of Aa3 with Moody’s.

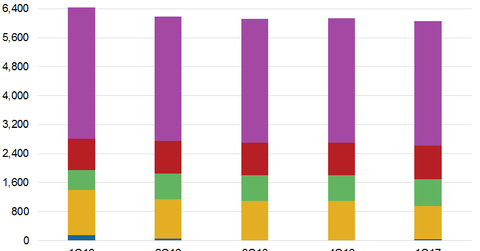

Prospect Capital has also diversified its counterparty risk by involving 21 institutional lenders in its facility as of September 30, 2016, compared to five lenders in 2010. The company had $4.8 billion of unencumbered assets on its balance sheet in fiscal 1Q17, making up almost 76.0% of its total assets. Prospect’s balance sheet assets have risen marginally to ~$6.3 billion compared to ~$6.2 billion on June 30, 2016. Its net assets stood at $3.4 billion on September 30, 2016.

Next, we’ll see how Prospect Capital is targeting higher ROE (return on equity) on its new investment pipeline.