How GDP Numbers Impacted Gold and the Dollar

The reason behind the fall of the dollar on Friday, January 27, 2017, was lower-than-expected GDP numbers. The DXY ended the day 0.10% higher.

Jan. 31 2017, Updated 12:36 p.m. ET

US dollar’s ups and downs

As we saw in the previous part of this series, the US dollar and precious metals were both impacted by GDP numbers that came out on Friday, January 27, 2017. The US dollar often negatively reacts to any pessimism in US markets.

The reason behind the fall of the dollar on Friday was lower-than-expected GDP numbers. However, the U.S. Dollar Index (or DXY), which measures the dollar against a basket of six major world currencies, ended the day 0.10% higher than the previous day.

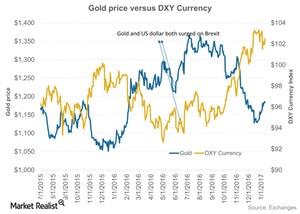

You can see the movements in gold and the US dollar in the graph below, which indicates an inverse relationship. The higher the dollar, the lower the demand for dollar-denominated assets. Optimism in the overall US economy could boost the dollar.

Correlation between the US dollar and gold

The correlation between gold and the DXY is -0.43, which means that about 43.0% of the time, gold and the dollar move in opposite directions. Silver’s correlation with the DXY is also -0.43.

Changes due to movements in the dollar can be seen in funds such as the ETFS Physical Swiss Gold (SGOL) and the ETFS Physical Silver (SIVR). These two funds saw losses during the past one week. They fell 1.9% and 2.0%, respectively on a five-day trailing basis.

The reaction in precious metals due to dollar changes can also affect mining stocks such as B2Gold (BTG), Iamgold (IAG), Alacer Gold (ASR), and Harmony Gold (HMY).