Delphi Automotive Declared a Dividend of $0.29 per Share

Delphi Automotive declared a quarterly cash dividend of $0.29 per share on its common stock. The dividend will be paid on February 15, 2017.

Jan. 27 2017, Updated 2:35 p.m. ET

Price movement

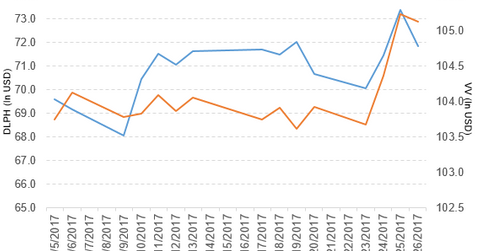

Delphi Automotive (DLPH) has a market cap of $19.8 billion. It fell 2.1% and closed at $71.86 per share on January 26, 2017. The stock’s weekly, monthly, and YTD (year-to-date) price movements were -0.21%, 6.0%, and 6.7%, respectively, on the same day. Delphi Automotive is trading 2.7% above its 20-day moving average, 5.0% above its 50-day moving average, and 5.9% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.09% of its holdings in Delphi Automotive. VV’s YTD price movement was 2.7% on January 26.

The market caps of Delphi Automotive’s competitors are as follows:

Delphi declared a dividend

Delphi Automotive declared a quarterly cash dividend of $0.29 per share on its common stock. The dividend will be paid on February 15, 2017, to shareholders of record at the close of business on February 6, 2017.

Performance in 3Q16

Delphi Automotive reported net sales of $4.1 billion in 3Q16—a rise of 13.9% compared to its net sales of $3.6 billion in 3Q15. Sales in its Electrical/Electronic Architecture, Powertrain Systems, and Electronics & Safety segments rose 17.8%, 1.2%, and 14.2%, respectively, in 3Q16—compared to 3Q15. The company’s operating margin narrowed by 150 basis points in 3Q16—compared to 3Q15.

Its net income and EPS (earnings per share) fell to $293.0 million and $1.07, respectively, in 3Q16—compared to $404.0 million and $1.42, respectively, in 3Q15. It reported adjusted EPS of $1.50 in 3Q16—a rise of 17.2% compared to 3Q15. Delph Automotive’s cash and cash equivalents fell 26.2%, while its inventories rose 16.4% in 3Q16—compared to 4Q15.

Projections

Delphi Automotive made the following projections for 2016:

- revenues of $16.4 billion–$16.5 billion

- adjusted operating income of $2.16 billion–$2.19 billion

- adjusted EPS of $6.00–$6.10

Next, we’ll look at Allison Transmission Holdings (ALSN).