How China’s Weakening Economy Could Hurt Macao Casinos

The Macao region relies heavily on the Chinese mainland, as it garners the huge majority (about 67%) of its visitors and VIP gamers from China and its neighboring countries.

Jan. 9 2017, Updated 10:36 a.m. ET

China: Macao’s key market

The Macao region relies heavily on the Chinese mainland, as it garners the huge majority (about 67%) of its visitors and VIP gamers from China and its neighboring countries. The weakness in the Chinese economy will adversely affect the spending capacity of the people in the country, which in turn could lead to a fall in the number of visitors visiting the Macao region. Along with the weaker Chinese economy, the devaluation of the yuan has also added to the woes of Macao, as it makes everything more expensive in the region.

Chinese economic slowdown

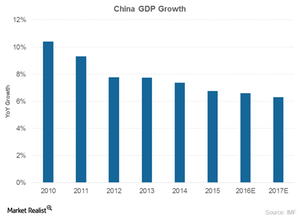

For 3Q16, China’s GDP rose 6.7%, in line with the government’s targeted growth. This growth is similar to the growth seen in the past two quarters. The growth in 3Q16 was due to the increase in fixed asset investment, government spending, and retail sales. However, industrial output has slowed down.

The Chinese government expects a 6.5%–7% growth for 2016. For 2017, GDP growth is expected to slow down to 6.3%. Analysts think this target also looks far-fetched given the falling commodity prices, overcapacity in many industries, and low global demand. However, the recent stimulus package makes it look possible.

Pockets of growth

According to China’s National Bureau of Statistics, China’s industrial production rose 6.1% year-over-year in 3Q16, which was lower than expected. Industrial production helps us gauge changes in the business cycle and is a leading economic indicator.

For 3Q16, China’s retail sales rose 10.7% YoY, indicating growth in consumer spending. Fixed asset investment rose 8.1% in the first 11 months of 2016. China’s fixed investment dipped below the 10% mark for the first time since 2000 in May 2016.

China, however, remains a key risk for global investors, especially as it tries to shift from an investment-based economy to a consumption-led one.

Investors seeking diversified exposure to casino companies may be interested in ETFs that invest in casino stocks like the VanEck Vectors Gaming ETF (BJK). Investors can also invest in the WisdomTree Dividend ex-Financials Fund (DTN), which holds 1.6% in LVS.