Why Vodafone Italy’s EBITDA Margin Keeps Growing

In fiscal 1H17, Vodafone Group’s (VOD) revenue in Italy (EWI) rose ~2.5% YoY (year-over-year) to ~3 billion euros (about $3.13 billion) in fiscal 1H17.

Dec. 23 2016, Published 1:51 p.m. ET

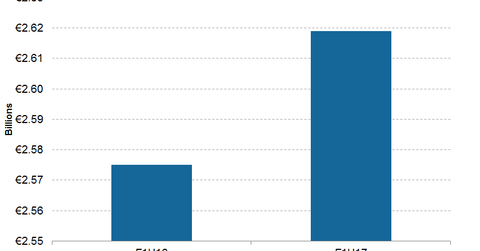

Vodafone’s service revenue in Italy

completed on12/22/2016 while its Italy’s service revenue rose ~1.7% YoY to ~2.6 billion euros (about $2.72 billion). This rise was due to mobile ARPU (average revenue per user) growth and strong fixed customer momentum.

Excluding currency and merger and acquisition impacts, Vodafone’s revenue rose ~2.5% YoY in Italy during fiscal 1H17. Organically, the company’s service revenue in Italy rose ~1.7% YoY during the period.

In fiscal 1H17, Vodafone’s mobile service revenue in Italy rose ~1.5% YoY to ~2.2 billion euros (about $2.3 billion). Vodafone Italy’s fixed-line service revenue rose ~2.6% YoY to ~0.4 billion euros (about $0.42 billion).

Vodafone Italy’s EBITDA (earnings before interest, tax, depreciation, and amortization) margin rose to 36.7% in fiscal 1H17 from 34.1% in fiscal 1H16. This was driven by strong revenue performance, low commercial costs, and cost controls.

Mobile customer metrics in Italy

Vodafone Italy’s mobile customers had reached ~23.5 million by the end of fiscal 1H17. But in fiscal 2Q17, on a net basis, the company lost around 8,000 contract customers in Italy. The company’s prepaid net losses of customers reached 281,000 in Italy during fiscal 2Q17, while Vodafone Italy’s fixed broadband customers came in at around 2 million at the end of fiscal 1H17.