Jefferies Rated Delphi Automotive as a ‘Buy’

On November 30, 2016, Jefferies initiated its coverage of Delphi Automotive with a “buy” rating and set the stock’s price target at $80.00 per share.

Dec. 1 2016, Updated 5:04 p.m. ET

Price movement

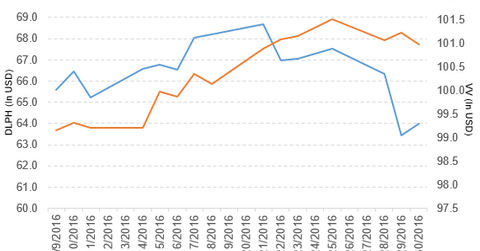

Delphi Automotive (DLPH) has a market cap of $17.3 billion. It rose 0.88% to close at $64.00 per share on November 30, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -4.5%, -1.2%, and -24.0%, respectively, on the same day.

DLPH is trading 4.2% below its 20-day moving average, 4.7% below its 50-day moving average, and 5.8% below its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.09% of its holdings in Delphi Automotive. The YTD price movement of VV was 9.6% on November 30.

The market caps of Delphi Automotive’s competitors are as follows:

DLPH’s rating

On November 30, 2016, Jefferies initiated its coverage of Delphi Automotive with a “buy” rating and set the stock’s price target at $80.00 per share.

Performance of Delphi Automotive in 3Q16

Delphi Automotive (DLPH) reported net sales of $4.1 billion in 3Q16, a rise of 13.9% compared to its net sales of $3.6 billion in 3Q15. Sales in its Electrical/Electronic Architecture, Powertrain Systems, and Electronics & Safety segments rose 17.8%, 1.2%, and 14.2%, respectively, in 3Q16 compared to 3Q15. The company’s operating margin narrowed 150 basis points in 3Q16 compared to 3Q15.

Its net income and EPS (earnings per share) fell to $293.0 million and $1.07, respectively, in 3Q16, compared to $404.0 million and $1.42, respectively, in 3Q15. It reported adjusted EPS of $1.50 in 3Q16, a rise of 17.2% compared to 3Q15. Delphi’s cash and cash equivalents fell 26.2%, and its inventories rose 16.4% in 3Q16 compared to 4Q15.

Projections

Delphi Automotive (DLPH) has made the following projections for 2016:

- revenues in the range of $16.4 billion–$16.5 billion

- adjusted operating income in the range of $2.16 billion–$2.19 billion

- adjusted EPS in the range of $6.00–$6.10

- cash flow from operations of $1.9 billion

- capital expenditure of $800 million

- adjusted effective tax rate of 17%

Next, we’ll look at Gentex Corporation (GNTX).