Comparing Domino’s and Papa John’s Dividend Policies

Importance of dividends Dividends help smooth out return volatility for shareholders. Both Domino’s Pizza (DPZ) and Papa John’s (PZZA) have a strong history of returning cash to shareholders. . 3Q16 dividends In 3Q16, Domino’s Pizza paid dividends of $0.38, which represents a growth of 22.6% from $0.31 in fiscal 3Q15. For the next four quarters, […]

Aug. 18 2020, Updated 6:22 a.m. ET

Importance of dividends

Dividends help smooth out return volatility for shareholders. Both Domino’s Pizza (DPZ) and Papa John’s (PZZA) have a strong history of returning cash to shareholders.

3Q16 dividends

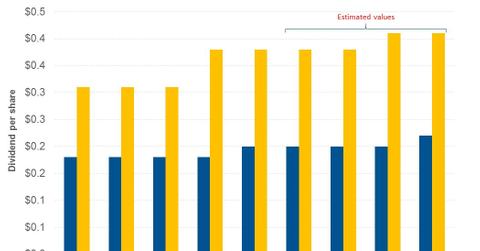

In 3Q16, Domino’s Pizza paid dividends of $0.38, which represents a growth of 22.6% from $0.31 in fiscal 3Q15. For the next four quarters, analysts expect Domino’s Pizza to post dividends of $1.60, which represents a growth of 14.5% from corresponding quarters of the previous year.

Papa John’s paid dividends of $0.20 in 3Q16, which represents a growth of 11.1%. For the next four quarters, analysts expect Papa John’s to post dividends of $0.82, which represents a growth of 10.8%. During 3Q16, Yum! Brands (YUM) paid dividends of $0.51, which represents a growth of 10.9% from $0.46 in 3Q15.

Capital allocation

Apart from paying dividends, both Domino’s Pizza and Papa John’s reward shareholders with share repurchases or buybacks. During the last 12 months, Domino’s Pizza has repurchased shares worth approximately $883.9 million, and by the end of 3Q16, the company had approximately $165.5 million under its share repurchase program.

Papa John’s has repurchased shares worth approximately $149 million in the last 12 months, and by the end of 3Q16, the company had $95.9 million under its share repurchase program. Next, we’ll look at Domino’s and Papa John’s valuation multiples.