Goldman Sachs Rated WestRock Company as ‘Neutral’

WestRock (WRK) reported fiscal 3Q16 net sales of $3.6 billion, a rise of 44.0% compared to net sales of $2.5 billion in fiscal 3Q15.

Sept. 26 2016, Updated 10:05 a.m. ET

Price movement

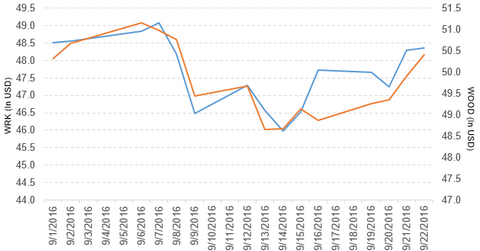

WestRock Company (WRK) has a market cap of $12.2 billion. It rose 0.14% to close at $48.36 per share on September 22, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 3.9%, 8.2%, and 9.2%, respectively, on the same day.

WRK is trading 1.7% above its 20-day moving average, 7.6% above its 50-day moving average, and 21.5% above its 200-day moving average.

Related ETF and peers

The iShares Global Timber & Forestry ETF (WOOD) invests 3.9% of its holdings in WestRock. The ETF tracks the 25 largest publicly listed companies that own or manage forests and timberlands. The YTD price movement of WOOD was 5.5% on September 22.

The market caps of WestRock’s competitors are as follows:

WestRock’s rating

Goldman Sachs has initiated the coverage of WestRock Company with a “neutral” rating and set the stock’s price target at $53.00 per share.

Performance of WestRock in fiscal 3Q16

WestRock (WRK) reported fiscal 3Q16 net sales of $3.6 billion, a rise of 44.0% compared to net sales of $2.5 billion in fiscal 3Q15. Sales from its Corrugated Packaging and Consumer Packaging segments rose 4.3% and 137.0%, respectively, in fiscal 3Q16 compared to fiscal 3Q15.

WRK reported sales of land and development of $42.0 million, respectively, in fiscal 3Q16. It reported restructuring and other costs of $43.1 million in fiscal 3Q16 compared to $13.1 million in fiscal 3Q15. The company’s gross profit margin fell 2.4%, and its operating profit rose 8.5% in fiscal 3Q16 compared to fiscal 3Q15.

Its net income and EPS (earnings per share) fell to $92.3 million and $0.36, respectively, in fiscal 3Q16 compared to $156.4 million and $1.10, respectively, in fiscal 3Q15. It reported adjusted EPS from continuing operations of $0.71 in fiscal 3Q16.

WestRock’s cash and cash equivalents rose 24.5%, and its inventories fell 4.0% in fiscal 3Q16 compared to fiscal 4Q15. Its current ratio fell to 1.7x, and its debt-to-equity ratio rose to 1.3x in fiscal 3Q16 compared to a current ratio and a debt-to-equity ratio of 1.9x and 1.2x, respectively, in fiscal 4Q15.

In the next part, we’ll discuss Domtar Corporation (UFS).