How Much Have MLP Fund Inflows Improved in 2016?

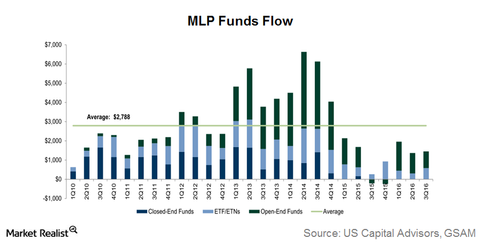

MLP funds’ capital inflows have recovered in 2016 from levels in 2H15. But overall capital inflows are lower than the seven-year average of $2.8 billion.

Nov. 16 2016, Updated 10:04 a.m. ET

MLP funds’ capital inflow

MLP (master limited partnership) funds’ capital inflows have recovered slightly in 2016, as compared to levels during the second half of 2015. However, their overall capital inflows are still lower than the approximate seven-year average of $2.8 billion.

Open-end funds

The share of open-end funds in MLP total capital inflows is higher than those of exchange-traded products like ETFs and ETNs. The advantage of open-end funds is active management. In the current volatile commodity price environment, active management should be preferable to passive strategies of exchange traded products. However, this comes with a price in terms of higher expenses. This brings down overall fund returns, and the effect is magnified when MLPs are not doing well.

Exchange-traded products

Open-end funds are followed by passively managed, exchange-traded products in terms of MLP fund flows. These include ETFs and ETNs, which track the performance of MLP indexes. MLP ETNs currently make up 35% of all US ETNs by market capitalization.

ETNs are similar to ETFs but are structured as debt security issued by an underwriting bank. ETNs have a maturity date and are backed by the credit of the issuer. This means that ETNs have credit risk in addition to market risk.

Two of the most well-known MLP ETFs and ETNs are the Alerian MLP Index (AMLP) and the JPMorgan Alerian MLP Index ETN (AMJ). Enterprise Product Partners (EPD) and Energy Transfer Partners (ETP) are the top holdings of AMLP and AMJ.