How Did IFF’s Fragrances Segment Perform in 3Q16?

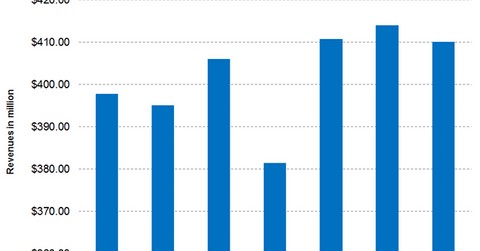

IFF’s Fragrances segment reported revenues of ~$410.1 million in 3Q16, as compared to $406 million in 3Q15, implying a 1.0% YoY rise.

Nov. 11 2016, Updated 8:04 a.m. ET

IFF’s Fragrances Business 3Q16 revenue

International Flavors and Fragrances’ (IFF) Fragrances segment reported revenues of ~$410.1 million in 3Q16, as compared to $406 million in 3Q15, implying a 1.0% YoY (year-over-year) rise. The segment represented 52.8% of the company’s total revenues in 3Q16.

In 3Q16, this unit reported an operating profit of $85 million, as compared to ~$90.9 million in 3Q15, which implies a 6.5% YoY fall.

Driving factors

The increase in the segment’s revenue was primarily driven by acquisition growth related to IFF Lucas Meyer Cosmetics. Revenue from the fine fragrances fell due to weaker demand in Latin America and Western Europe. Consumer fragrances remained flat, while fragrance ingredients grew, driven by both organic growth as well as acquisition growth from IFF Lucas Meyer Cosmetics.

The fall in this segment’s operating profit was primarily driven by unfavorable mix, manufacturing performance, and increased selling and administrative expenses, which were partially offset by cost savings and productivity initiatives.

Latest acquisition update

On November 3, IFF announced that it had entered into an agreement to acquire Fragrance Resources, a privately held company. IFF expects to close the deal in early 2017, and Fragrance Resources is expected to add $75 million to IFF’s total revenues in 2017.

Investors can indirectly hold International Flavors and Fragrances by investing in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ), which had 3.8% of its holdings in IFF on November 8. The top holdings of this fund include Ashland Global Holdings (ASH), Chemours (CC), and International Paper (IP), which had weights of 5.5%, 6.1%, and 5.0%, respectively, on November 8.