IFF Is Trading High: Can This Continue ahead of Its 3Q16 Results?

International Flavors and Fragrances (IFF) is set to report its 3Q16 earnings after the market closes on November 7, 2016.

Nov. 3 2016, Published 4:04 p.m. ET

IFF to announce its 3Q16 earnings

International Flavors and Fragrances (IFF) is set to report its 3Q16 earnings after the market closes on November 7, 2016. IFF will hold a conference call on November 8, 2016, to discuss its results with the investment community and security analysts.

Series overview

In this series, we’ll take a look at International Flavors and Fragrances’ stock performances so far in 3Q16 and 4Q16. We’ll also look at analysts’ expectations for IFF’s revenue and margins, along with other metrics. Finally, we’ll take a look at IFF’s valuations compared to those of its peers.

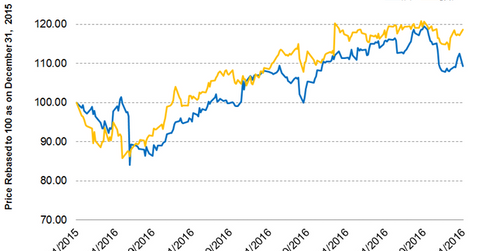

IFF’s stock performance

IFF’s stock price touched an all-time intraday high of $143.43 in 3Q16. In the span of three months, from July 1 to September 30, 2016, IFF returned 13.4%, outperforming its peers such as Sensient Technologies (SXT), Praxair (PX), and Air Products and Chemicals (APD), which returned 6.7%, 7.5%, and 4.4%, respectively, in the same period.

Praxair and Air Products and Chemicals are not the perfect competitors for IFF. IFF’s stock was trading high due to positive business development. IFF has made a strategic investment in Bio ForeXtra, which specializes in botanical extracts. This deal has given IFF access to raw materials for its cosmetic active business. IFF has also acquired David Michael & Co. to strengthen its North American flavors business.

ETF investment

Investors can indirectly hold IFF by investing in the PowerShares DWA Basic Materials Momentum ETF (PYZ), which has invested 3.7% of its holdings in IFF as of November 2, 2016. In the next article, we’ll analyze analysts’ revenue estimates for IFF in 3Q16.