National Oilwell Varco’s Growth Prospects in 2017

National Oilwell Varco’s (NOV) management expects upstream activity in North America’s shale plays to improve in 2017.

March 8 2017, Updated 5:35 p.m. ET

Does NOV’s management see a recovery in 2017?

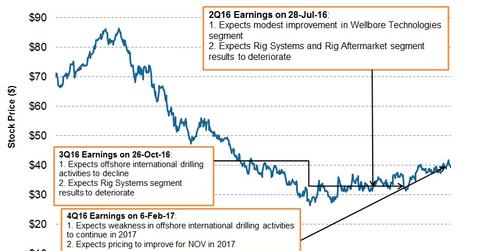

National Oilwell Varco’s (NOV) management expects upstream activity in North America’s shale plays to improve in 2017. However, NOV’s management also thinks that the decline in offshore drilling continues to drag many international markets.

Clay C. Williams, National Oilwell Varco’s chairman and CEO, commented during the 4Q16 conference call, “In the fourth quarter, we benefited from rising momentum in North American shale plays in particular, which we expect to accelerate. Our international markets still face headwinds for a quarter or two and offshore markets continue to trend down, so we still have challenges ahead. Nevertheless, $50 oil has been a welcome relief.”

What are NOV’s challenges in 2017?

National Oilwell Varco’s management expects the offshore energy market and parts of its international operations to remain challenging in 2017. Its capital equipment sales have been weak, resulting from the downturn in the energy market.

National Oilwell Varco comprises 0.07% of the iShares Russell 1000 ETF (IWB). For investors looking for some exposure to the energy sector, energy makes up 6.3% of IWB.

National Oilwell Varco’s growth prospects for 2017

- National Oilwell Varco (NOV) received a project award in 4Q16 in the Anadarko Basin, which is located in Oklahoma and the Texas Panhandle.

- NOV received orders to provide 75,000 hydraulic horsepower of fracture stimulation pumps and associated support equipment during 4Q16.

- National Oilwell Varco recently acquired Axiom Process. This acquisition is expected to improve NOV’s Solids Control portfolio.

- NOV and Maersk Drilling, a drilling rig operator, entered into a five-year partnership. NOV plans to provide drilling equipment in seven of Maersk Drilling’s offshore floating rigs.

Next, we’ll discuss National Oilwell Varco’s revenues and earnings.