What Drove ONEOK’s 3Q16 Earnings Growth?

ONEOK (OKE) reported its 3Q16 results on November 1, 2016, after the market closed. Its 3Q16 analyst-adjusted earnings before interest, tax, depreciation, and amortization rose 14.4% from 3Q15.

Nov. 2 2016, Published 3:25 p.m. ET

ONEOK’s earnings rise 14%

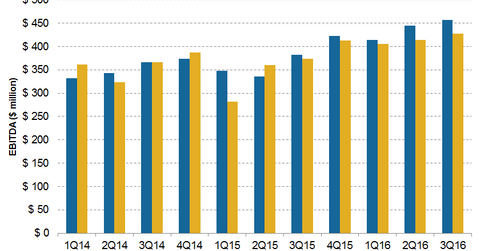

ONEOK (OKE) reported its 3Q16 results on November 1, 2016, after the market closed. Its 3Q16 analyst-adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) rose 14.4%, from $374.0 million in 3Q15 to $427.5 million in 3Q16. Analysts expected EBITDA of $457.2 million for the quarter. It missed EBITDA estimates for the quarter by 6.4%.

The above graph compares OKE’s EBITDA estimates with its adjusted EBITDA. Enterprise Products Partners (EPD) also missed analysts’ 3Q16 earnings estimates.

Higher volumes drive EBITDA growth

ONEOK operates as a pure-play general partner of ONEOK Partners (OKS). In 3Q16, the company’s EBITDA growth was driven by the following:

- higher NGL (natural gas liquid) volumes due to its Williston Basin processing plant recently being placed into service

- higher average fee rates as a result of contract restructuring efforts in the natural gas gathering and processing segment

- higher natural gas volumes in the Williston Basin

- higher transportation revenue

Terry K. Spencer, president and chief executive officer of ONEOK, said, “ONEOK continues to benefit from ONEOK Partners’ well-positioned assets and resulting volume growth from recently completed capital-growth projects.”

Strong dividend coverage

ONEOK’s cash flow available for dividends fell from $173.0 million in 3Q15 to $167.8 million in 3Q16, resulting in slightly lower dividend coverage. ONEOK reported coverage of 1.3x in 3Q16. On October 19, 2016, it declared quarterly dividends of ~$0.62 per share for 3Q16, unchanged from the previous quarter. OKE’s dividends were flat in 1Q16 and 2Q16 as well.