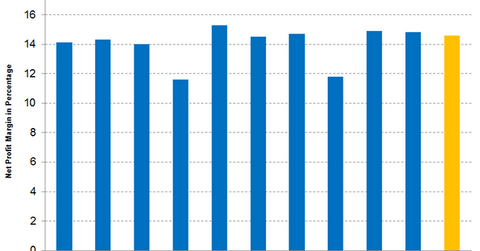

Can IFF Surprise Analysts with a Higher Net Profit Margin?

Wall Street analysts are expecting International Flavors and Fragrances (IFF) to post a net profit margin of 14.6% in 3Q16, compared to 14.7% in 2Q16.

Nov. 4 2016, Updated 8:04 a.m. ET

Analysts’ expectations for IFF’s net profit margin

Wall Street analysts are expecting International Flavors and Fragrances (IFF) to post a net profit margin of 14.6% in 3Q16, compared to 14.7% in 2Q16, implying a fall in its expected net profit margin by ten basis points (or bps) year-over-year (or YoY). Since 1Q14, IFF’s net profit margin has remained in the range of 11.6%–14.9%.

With more than 70% of IFF’s revenue being generated outside the United States, there’s always the risk of foreign exchange translations. The strengthening of the US dollar against Asian and other major currencies could impact the company’s net profit margin negatively.

Also, the company’s interest expenses in 3Q16 may be higher compared to 3Q15 due to its issuance of senior notes for 500 million euros at a coupon rate of 1.8% in March 2016.

However, using these proceeds, IFF will likely pay off $125 million worth of Series D notes, which carry a coupon rate of 6.1%. It also intends to repay its borrowings under its revolving credit facility. The rise in its interest component could impact its margins negatively.

Analysts’ EPS expectations

International Flavors and Fragrances hasn’t provided any guidance on its earnings per share (or EPS) for 3Q16. However, analysts are expecting IFF to post adjusted EPS of $1.42 in 3Q16, implying a rise in its adjusted EPS by 2.1% YoY. The rise in its expected adjusted EPS may be primarily driven by its share repurchase program.

At the end of June 30, 2016, IFF had repurchased ~623,000 shares. IFF’s board has authorized the repurchase program to buy back the shares until the end of 2017.

ETF investment

Investors can indirectly hold International Flavors and Fragrances by investing in the PowerShares DWA Basic Materials Momentum ETF (PYZ), which has invested 3.8% of its holdings in IFF as of November 2, 2016. The top holdings of this fund include Ashland Global Holdings (ASH), Chemours (CC), and International Paper Company (IP), which have weights of 5.5%, 5.1%, and 5.0%, respectively, as of November 2, 2016.

In the next article, we’ll analyze analysts’ recommendations on IFF.